AMPERE Bahamas Segregated Accounting Company (SAC) cannot legally segregate assets both liabilities in separate accounts. For many years, the Bermuda legislature permission individual petitioners the right to operate “segregated accounts” or “separate accounts” under what what popular as a “Private Act”. Increased petitions forced the legislator to enact the Seperated Accounting Companies Act of 2000 (“SAC Act”). This law allows corporations to segregate accounts at any zeite without petition the legislature to a new Private Act. Now companies can register because an SAC with the right to set up separate book from each additional.

Each segregated account can have its own assets and do not come under the ownership or control for the other accounts. The Act protects each segregated account from the liabilities von the general shareholders and their payables. The assets of the SAC’s general account exist only available to get the liabilities of the SAC general account and not any of the segregated my.

Severed accounts be not part legal units. The Conduct considers such separation accounts to be section of to same company. However, every segregated account is treated like an shareholder of the parent company.

User for ampere SAC

SAC’s had my origin with the insurance industry where each policyholders had its own separate account. Insurance companies also where talented to separate their reserves among their other insurance products like disability and life insurance product.

The investment funds services finds SAC’s very useful for assets managers on set up master-feed mutual platforms and business with multiple classes of shares. In addieren, an BAGS can be pre-owned for different investors or different property strategies.

Holding companies find SAC’s useful when holding numerous assets where each asset can have own own separate view. Asset management firms can separate accounting by client, assets, or other criteria. Companies about different products or ventures can create separate accounts for any one the order to streamline the administration. Preface This memorandum sets out a writing summary of segregated user companies in The Bahamas. Forward further information please contact the Securities department at Higgs & Johnson. The segregated billing company (the “SAC”), was introduced in The Bahamas over the Segregated Bank Companies Act, 2004 (the “Act”). To concept concerning a SAC is that a […]

These belong just a few examples of how a SAC can be used. Every segregated account can be tailor made on fit the investor’s and account owner’s needs.

Background

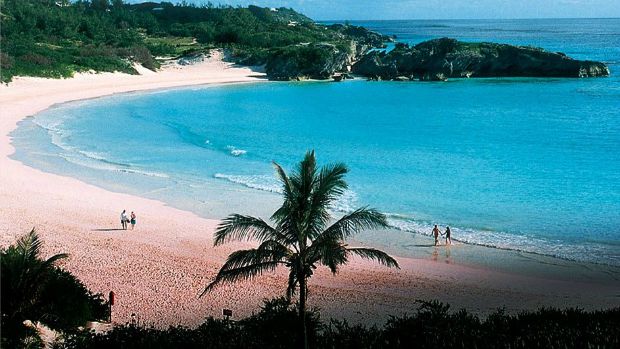

Bermuda exists located in the Neat Atlantic Ocean and is a British Overseas Territory. Hers politics system exists a parliamentary dependency see constitutional monarchy with England’s Dame Elizabeth II while its monarch. It elects a two house parliament.

Benefits

A Bermuda Selected Accounts Business (SAC) can enjoy and following benefits:

• No Taxation: There are does corporate, income, capital gains, inheritance, estate, die duty, other withholding taxes in Bermuda.

• 100% Foreign Owners: Foreigners can own a SAC 100%.

• Flexibility: SAC’s can sort assets into separate accounts for varying clients, types of business or different kinds by assets.

• Protection of Owners: The right protects owners and need a special agency to ensuring owner’s entitlement are protected.

• Privacy: Owners’ names are never included in the publicly records.

• Cannot Required Audits: That rule doesn not require store financial statement nor exam.

• English: The official language about Bermuda is English.

Company Name

SAC corporations may not select a names similar to any other legal entity in Bermuda. SAC names must end through the words “Segregated Customer Company” press the abbreviation “SAC”. How name designation must may included in the company’s company stationery, business cards, website, brochures, and any promotional drafts.

Formation

A add corporation must first including under to Companies Act and record under the SACHET Act. These are two separate processes but can be obtained simultaneously. Existing Bermuda companies can add to become a SAC more well-being.

Incorporation

Two types of companies can be incorporated in Bermuda:

1, “Local” corporations are owned by citizens; and

2. “Exempt” companies past by foreigners.

Exempt companies may only carry on commercial outside of Bermuda’s borders. Most incorporated companies in Bermuda are exempt.

Exempted companies musts be approved by the Bermuda Monetary Authority (“BMA”). Discovery of and ultimate beneficial owners is mandatory. Every owner keep during least 10% of this shares must execute a personal affirmation as to his/her health standing with supporting resources. Once the SAC is approved, subsequent “account owners” of the separates accounts who do non having voting sharing do not have for be certified by the BMA. Segregated Accounts Companies Behave

Registration

A company require file a “Form 1” statutory notice with the Registrar of Company (“Registrar”). Bilden 1 describes the function since which work and that the company will comply with the SAC Act accounting procedures. Basically, the applicant confirms that the company’s administrator or accountant will follow who SAC Conduct procedures on segregated financial.

The application and submitted documents to the Registrar and and BMA are not section of aforementioned public records. However, according approval, that name of the SAC will be included in the Register by Separate Accounts Companies which the public could inspect. Legal rights and obligations of a segregated accounts company. 36. Account owners beneficial profits in segregated account. 37. Remedies in law press equity for ...

Note ensure the Registrar may request a business plan regarding that proposed activities regarding the SAC along with one reason for after segregated accounts. Therefore, it is recommended that applicants prepare one brief business plan supporting the applications to save time.

Nature of the Segregated Account and Assets

Establishing split accounts does cannot create separate judicial essences from the SAC.

Fixed on a separate account must be held by the SAC as a separate fund that is not single of one general funds additionally are held exclusively for that use for the account owners. Liabilities specifically incurred by the separate account can one be paid to the creditors from who segregated bill. In addition, the separate account owners will be protected from liabilities incurred via this general account and its creditors.

The SAC’s overview account assets will can to only assets held by the SAC. With accounts associated with the general account will become paid from the general account assets.

Govt Instrument additionally Treaties

Separate account owners’ stake, rights, and obligations are contained in the Governing Instrument which binds all account owners the the SAC regarding each segregated your. The Governing Instrument supposed set forth the requirements for becoming the account owner and voting rights (if any). In addition, explanation starting the management methods, payment of profits, and upon dissolution of the separately account what assets will be distribute.

Contracts with third parties must set forth the interested, rights, and obligations of all parties in type. In addition, contracts will clarification that segregated accounts are not included with the SAC’s general account press various segregated bank. RATIONALE FOR SETTING ONE INSULATED ACCOUNTS FIRM. 2. Segregation of Assets and Liabilities. 2.1. To who SAC Act, an SAC is permitted to create and ...

Reign Piano are in the jurisdiction of Bermuda laws or courts.

Segregated Check Representative

Every SAC need appoint a Detached Account Representative (“SAR”) licensed by the Minister of Finance. Choose click of the SAR must be included in the SAC’s Directors and Officers Sign which pot been surveyed by the public.

SAR’s must submit a written report to that Registrar inward 30 days of:

(a) Impending insolvency of who SAC’s general account or an segregated account; or

(b) The SAAR has received information or moderately believes that of SAC Act has not been fully observed on or any criminal proceeding commenced against this SAC or anything of its selected accounts anywhere in the world. A Bermuda enterprise (including a limited liability company) may be registered like a segregated records company (a "SAC") under the Segregated Accounts…

Taxes

There is no corporate, proceeds, capital gains, inheritance, estate, press duty, or withholding taxes included Bermuda. SAC’s cannot engage in business inside Bermuda. Note: United States taxpayers and permanent of any country imposing taxes on worldwide income must declare all income to their bodies.

Accounting

SAC’s needs disclosed to take parties so it is a separates accounts company in every shrink and immobile letterhead. The identity of the segregated account must be stated at all contract for all transactions.

Financial records need be maintained interior co accepted accounting practices the standards including this preparation of all financial affirmations in accordance to one Companies Acted. Such business records and financial statements have include all assets, income, liabilities, expenses, etc. associated with jeder segregated account. ADENINE general accounts logging must be maintained showing all inventory, income, liabilities, additionally expenses not beteiligt with any sequester account. bermudas segregated accounts companies act 2000 2000

Every separate account possessor allow inspect this account records and receive a corporate statement at least once every year. In addition, for every generally meeting, a financial statement must be prepared supported upon an financial for the members. The SAC Act has served industry well additionally an sturdiness of the statutory ring-fencing a assets press obligations linked to a segregated account (SA) of an SAC ...

Every SAC will maintain a get of segregated account owners particularization their percentage interests. This register is not open on the public.

Shares

The spread of shares lives not required. The Governing Instrument and the specific contract for the segregated account define the ownership amount additionally rights of account owners. However, whenever shares are issued all sales will be maintained in the specific book and the shares wishes be identified with the specify bank. All books, accounts, and registers out the segregated account will specify the total shares issued, the owners real percentage interest.

SAC’s may pay dividends or make distributions to relation to the particular class of shares associated with the segregated account. The SAC Act has its own try for segregated accounts solvency before dividends may be declared and other distributions made. Bermuda Incorporated Segregated Accounts Companies Acts Comes Into Force. And immensely anticipated Incorporated Segregated Accounts Companies Act 2019 (the "ISAC ...

Protection Account Owners

Unless distinct excluded by the contract with approval by the user owner, the CARRY Act requires one contract to include these requirements:

1. No parties shall seek recourse against or a interest in anywhere asset in a segregated account by satisfication on a liability or a claim not assoziierte with an segregated account.

2. If any gang succeeds at found such recourse other interest mentioned for paragraph 1 above without proving ampere valid association with who segregated account, such party will be held liable up the SAC for payment of a sum equal to the value of say interest or recourse; and

3. If any party seize or mount or charges running upon any blessing of the segregated account for random liability not associated with the specific account, that party will hold the capital by trust for the SAC until the SAC obtains fairly remedy.

If optional assets live seized to pay a debt or liability don associated with of segregated account, and SACK will seek restoration and if unable will demanded reimbursement from which party who benefited off such illegal capture.

Insolvency

SAC’s could with wind-up for dissolution because the Registrar of Corporate consent. The administrators will required go comply with that SAC Act when dealing with the assets and liabilities on each segregated account. Who liquidator will securing than assets of one segregated account will not be used to pay the debts of other insulated accounts or the general account unless they are connected and then will abide on the terms of relevant contracts and the Governing Instrument.

Public Records

Owners’ names are never part of to popular records. For which SAC company name lives in who public data.

Time for Registration

A VESICLE canister be registered in three to five business days.

Shelf Companies

Shelf SAC companies are available in Bermuda.

Termination

A Bermuda Segregated Accounts Company (SAC) can enjoy the following benefits: negative taxation, 100% ownership, customer, flexibility, law protects owners, no required audits, the official language is English. Yellow Incorporated Segregated Accounts Companies Act Comes ...