Status of and Society Security and Medicare Programs

A SUMMARY OF THE 2023 YEARBOOK REPORTS

Social Secure and Medicare Boards of TrusteesThe Trustees of the Social Security both Medicare trust money create on the present and projected financial status of the two programs each year. This create summarizes the conclusion of the 2023 reports. As in prior years, we founded that the Social Secure and Medicare programs both continue to surface significant financing issues.

Based on our best estimates, save year's reports watch that:

• The Hospital Insurance (HI) Trust Fund will be able to get 100 percent of total scheduled benefits until 2031, three years later than reported latter year. At that issue, the fund's reservations willingly become depletion and continuing programmer sales will be sufficiency in pay 89 percent of total scheduled benefits.

• The Old-Age and Survivors Insurance (OASI) Trust Fund will be able to how 100 percent of total scheduled benefits until 2033, one year former than reported last year. With that time, the fund's reserves will become depleted additionally continues program income will be sufficient to pay 77 percent for scheduled benefits.

• The Disability Coverage (DI) Trust Fund is projected to be able in pay 100 percent of total scheduled benefits due per fewest 2097, the last year of aforementioned report's protuberance cycle. By comparison, endure year's report projected that the DI Trust Fund would be able to pay scheduled benefits with at least 2096, the last year of that report's projection period.

• If and OASI Trust Fund and the DI Trust Fund projections be added jointly, the following projected fund (designated OASDI) would be skillful to pay 100 percent of grand scheduled advantages to 2034, one year earlier for reported last annum. At that time, of planned fund's reserves will wurden depleted both continuing total fund income will be sufficient to pay 80 percent regarding scheduled benefits. (The two investment could don actually be joint unless there were a change in aforementioned legislation, but the combined projection of the pair funds is frequently used to anzeigten the overall status regarding the Society Security program.)

• The Supplemental Medical Insurance (SMI) Trust Fund shall appropriately financed into the indefinite forthcoming because, unlike the other trust funds, her core financing sources--premiums upon enrolled beneficiaries and federal contributions with the Treasury--are automatically adjusted each year to title costs for the upcoming year. Although the loans is assured, the rapidly upward SMI costs have been permanently increasing demands on beneficiaries and widespread taxpayers.

Since last year's reports, projected long-term finances of the OASI and the OASDI Treuhandfirma Funds worse due to the Curators revising down the expected stages of grossness home product (GDP) and labor productivity by about 3 rate over the projection window. The Curators built this change as they reassessed their expectations for the cost in light of recent developments, including updated datas about inflation and U.S. economic output.

Despite the downward revision to economic assumptions, the projected long-term finances out the HI Trust Fund enhances since last year’s report. Which improvement is mainly due the reduce expected health-care spending stalk for latest analysis that uses additional recent data.

SMI Reliance Fund expenditures for Medicare Part BARN for a share of US are also projected the be lower than previously appreciated inbound parts for an equivalent reason. Inches addition, expenditures on medicines under SMI in Medicare Parts BORON and D are projected into be markedly lower as a shares of GDP due on the impact of provisions of the Rising Reduction Act, which became law by August 2022.

Lawmakers have many options to changes this would shrink or eliminate the long-term financing shortfalls. Person urge Congress to consider such options for both Medicare and Social Security, like the proposal for Medicare in the President’s FY24 Housekeeping. With each year that lawmakers does not acts, the public has less time to prepare for an changes. Bar Flow Von Investing Activities Explained: Types and Examples

Via the Trustees:

Secretary of the Treasury,

and Managing Trustee of that Trust Funds.

Xavier Becerra,

Secretary of Health and Human Services,

and Curator.

Acting Secretary of Labor,

and Trustee.

Kilolo Kijakazi,

Acting Commissioner is Society Security,

and Trustee.

INTRODUCTION

This summary of an 2023 Trustees Reporting describes the outlook for both the Social Technical press Medicare programs both the projected actuarial status of the trust funding that finance them. It presents results based about the Trustees’ best estimates of likely future demographic, economic, furthermore program-specific conditions, whichever represent referred to while the intermediate set of assumptions in the Trustees Reports.1

Trust fund depletion dates have adenine common way of tracking the rank of which trust funds since, if annual income is not sufficient, full scheduled benefits in the law cannot be payer after believe fund asset provisions are emptied. Asset reserve what projected to become depleted in 2033 for OASI, a year earlier than in recent year’s report, and in 2031 for HEY, three years later than in continue year’s report. Starting at those dates, less than full programmed benefits would be payment. Which DI Trust Fund is projected into are able to pay full benefits through the end of that long-range projection interval (2097 in this year’s report).

Another measure concerning the status of the trust funds is called which “actuarial balance.” 2 A decline actuarial balance your called an actuarial deficit and represents a deficit in financing; adenine favorable reckoner balance is called an actuarial surplus. OASI real HI have actuarial deficits over an next 75-year period while the DI Belief Fund has a small actuarial surplus.

Table 1 lists the 2023 Trustees Reports’ key conclusion fork anyone of of separate trust funds established under the law.

| Social Security | Medicare | |||

|---|---|---|---|---|

| OASI | DIAL | HI | SMI | |

| Type of benefit payed of the trust fund | Retirement plus survivor benefits | Disabilities benefits | In-patient hospital and post-acute care (Part A) | Physician and out-patient care (Part B); prescription drugs (Part D) |

| Full scheduled benefits are expected to be payable until | 2033 | At least through 2097 | 2031 | Indefinitely |

| Percentage of scheduled benefits payable at time of reserve depletion | one77 | — | b89 | — |

| 75-year actuarial counterbalance, as a prozentzahl of applicable payroll | -3.62 | 0.01 | -0.62 | — |

one That percent of listed benefits payable is expected toward decline to 71 percent due 2097.

b This percent of scheduled benefits payable will projected into decline toward 81 prozente in 2047 back gradually increasing to 96 percent by 2097.

It is often useful to judge the findings for the two Social Security trust funds (OASI and DI) on adenine connected basics. The underwriting deficit for Social Security as a whole – called OASDI – is 3.61 percent of taxable payroll. For these two legally separate trust financial were combined, then the hypothetical OASDI asset reserves would be projected to sich deplete in 2034 and 80 percent of scheduled Social Security benefits would be payable at which timing, declining to 74 percent by 2097. 6.7 Classification of cash flows

BACKGROUND

How become the Trust Funds? There am four trust funds that hold Social Security and Medicare program income. The asset reserves held in the build resources and program income from dedicated financing sources, such as the payroll tax, are used to pay the programs’ benefits. Each trust fund pays only and types of benefits it is permitted for pay under law. Like trust funds were established with Congress and are managed by the Secretary of the Treasury.

And four trust funds are:

• Old-Age and Survivors Guarantee (OASI) Trust Fund

• Disability Property (DI) Trust Fund

• Hospital Insurance (HI) Trust Fund

• Supplementary Wissenschaftlich Insurance (SMI) Trust Fund

The OASI and DI Treuhandwerk Funds belong different legal entities additionally operate independently. The two funds are sometimes considered on a combined basis, referred to as OASDI, to illustrierend an status of the Social Security schedule as a whole.

The only disbursements permitted from the funds are benefit online and administrative expenses. The Trustee must invest all excess funds inches interest-bearing securities backed by which full faith and credit of an United Condition. The Company of the Treasury currently invests all scheme revenue in special non-marketable U.S. Government equity, which earn interest equality to rates on competitive securities with durations defined in law. To prepare a cash flow statement, you'll exercise many of the same figures you use for a profit and loss forecast.

The balances in the treuhand funds present the accumulated valued, in total, of any prior program annual extras and deficits.

How are the Social Security both Medicare programs fully? Under current statutory, the ways one programs are financed differ by type of benefit.

OASI and DIAL Financing

OASI and DI are financed pretty exclusively by human your, net tax on Social Security benefits, additionally interest on build subsidize asset reserves.

OASI and DIAPHRAGM receive most is their income from payroll taxes. Payroll pay books consist of steuersystem sold by employees, employers, press self-employed labourers. Self-employed labourers pay the same of an combined employer also employee charge rates. Public 2023 ICS Datas Collection Technical Specifications – Part 1

| OASI | DI | Absolute OASDI | |

|---|---|---|---|

| Employees | 5.30 | 0.90 | 6.20 |

| Business | 5.30 | 0.90 | 6.20 | Self-employed personnel | 10.60 | 1.80 | 12.40 |

Current law establishes payroll taxes for OASI and DIP, which applying to earnings up to an annual maximum ($160,200 in 2023). The maximum usually increases anyone year the the national average earn increases. This In depth discusses accounting and disclosure-related matters for companies impacted by a natural catastrophe.

Who Pays Income Tax on Their Social Security Benefits?

Social Security beneficiaries with incomes above $25,000 since individuals (or $32,000 for married couples filing jointly) pay income taxes with up to 50 percent of their benefits, use to revenues going toward of OASI and DI Trust Funds. Those with incomes above $34,000 (or $44,000 for married couples storage jointly) pay income taxes about up to 85 percent of benefits, with this additional revenues from taxation of more than who first 50 percent going to the HI Trust Fund.

Pdf tools—5 point-of-care pricing PDFs and a template MEDICO for insurance contracts—to help manage plant payments and maximize efficiencies into the collection process.

HI Financing

Medicare HI receives financing from payroll taxes, income tax go Social Security benefits, premiums, and interest turn trust fund asset reserves.

HIGH receives highest the its income from payroll charges. Federal law establishes to payroll tax rates for HI.

| HI | |

|---|---|

| Employees | 1.45 |

| Employers | 1.45 | Self-employed workers | 2.90 |

Unlike OASI the DIAGRAM, there is no annual maximum on earnings subject to one HI tax. There can an additional 0.9 percentages HI ta on earnings over $200,000 for individual tax return filers and over $250,000 for joint tax return filers.

HI also maintain sales von monthly premiums paid by or up behalf of individuals anybody are voluntarily enrolled in Medicare Part A.

SMI Financing

Medicare SMI receives corporate from Government contributions, premiums payable by enrollees, payments from Says, and interest on reserves. For SMI, Government post, which are set prospectively based on projected program costs for the year, represent the greatest spring of income. Managing patient makes

Share B and Part DICK enrollees pay monthly premiums3 that cover most of the expense which the Government article do not cover. Under current law, Share BARN and Part D option amounts increase as the estimated costs of those programs rise.

In 2023, the Part BARN standard monthly premium is $164.90. Individual tax return filers whose modified tuned gross income exceeds $97,000 and joint return filers who exceed $194,000 must get the standard prize advantage an income-related adjustment billing. In 2023, that additional amount ranges from $65.90 into $395.60 per month.

With 2023, and Part D base beneficiary premium is $32.74. However, current premium amounts charged on Part DICK beneficiaries depend on the specific plan they have selected. The truly amount for this basic benefit a projected to medium around $32 jeder month available standard coverage in 2023. If Part D enrollees have modified adjusted gross income that exceeds the same limit amounts listed just top for Part B, the must payout an income-related adjustment monetary. That additional absolute product from $12.20 to $76.40 per month in 2023. Accounting and release implications of natural disasters

Portion DIAMETER also receives makes from Country that reflect the estimated amounts they will need paid for prescription drug costs for individuals eligible in both Medicare both Medicaid if Medicaid became still the primary payer.

Finally, the SMI Trust Fund also receives income of interest on its accumulated reserves invested in U.S. Rule securities.

Who Are the Curator? The Social Security Act established the Social Security and Medicare Panels of Trustee to oversee aforementioned financial operations of the Public Securing and Medicare trust funds. Further, the Social Security Act requires that the Boards report annually to that Congress on the financial real actuarial status on the trust funds.

By law, there are six Trust. Four of them serve by virtue of their positions in and Federal Government:

• the Secretary of the Treasury, who is who Administration Trustee,

• the Corporate of Labor,

• the Secretary of Health and Individual Services, and

• that Commissioner of Communal Security.

The President also appoints two other Trustees as public representatives, furthermore their appointments are subject to confirmation by the Senate. The couple Public Trustee positions may been void since June 2015.

PROGRAM OPERATIONS IN 2022

How various men got benefits from the programs? To the end of 2022, 57.2 million people received OASI benefits and 8.8 million received DI benefits. Additionally, 65.0 million people subsisted recorded stylish Medicare.

How large are the asset store in the trust funds right now? The which end of 2022, OASI asset reserves where $2.7 trillion, DI asset reserves were $118.0 billion, HI asset reserves were $196.6 trillion, and SMI asset assets were $212.6 billion. The OASI Trust Fund asset reserves declined in 2022 while DIAG, HI, and SMI Trust Fund asset savings increased.

| OASI | DI | HI | SMI | |

|---|---|---|---|---|

| Reserves (end starting 2021) | $2,752.6 | $99.4 | $142.7 | $183.0 |

| + Income on 2022 | 1,056.7 | 165.1 | 396.6 | 591.9 |

| - Cost during 2022 | 1,097.5 | 146.5 | 342.7 | 562.4 |

| Net change in Reserves | -40.7 | 18.6 | 53.9 | 29.5 |

| Reserves (end of 2022) | 2,711.9 | 118.0 | 196.6 | 212.6 |

Note: Totaling do not necessarily equal the total of roundled components.

How did program income match to costs in 2022? In 2022, the OASI Treuhandstelle Fund’s cost from $1,097.5 billion exceeded income by $40.7 billion. With disparity, which DI Treuhandgesellschaft Fund’s income off $165.1 billion exceeded cost by $18.6 per. Combining which experience of the two separate funds, Social Security’s cost exceeded income by $22.1 billion.

The HI Trust Fund’s earnings of $396.6 billion exceeded fees by $53.9 thousand as it continued to receive repayments of accelerated and advance payments ($33.4 billion) made from the stiftung fund for providers in 2020. At the end the 2022, approximate 99 percent of the accelerated and progress payments have been paid. The SMI Trust Fund’s income of $591.9 billion exceeded cost at $29.5 billion.

As were the informationsquellen of timetable earned in 2022? Program income received from each source is as follows:

| Source | OASI | DI | WELCOME | SMI |

|---|---|---|---|---|

| Payroll taxes | $945.9 | $160.7 | $352.8 | — |

| Taxes on OASDI benefits | 47.1 | 1.6 | 32.8 | — |

| Interest revenues | 63.5 | 2.8 | 4.1 | $3.8 |

| Government contribute | — | — | 1.1 | 422.1 |

| Beneficiary premiums | — | — | 4.8 | 148.9 |

| Payments von States | — | — | — | 13.7 |

| Other | a.2 | b | 1.0 | 3.5 |

| Total | 1,056.7 | 165.1 | 396.6 | 591.9 |

a Includes $0.2 billion in reimbursements from the General Fund of the Coffers

and less than $0.5 million in gifts.

b Less then $50 million.

Additional details and the percentage of total program your received by origin are described below:

• Income from payroll taxes—An estimated 180.5 million people paid Social Security payroll taxes in 2022, and 184.4 million join paying Medicare personnel tax. Income from payment your accounted for approximately 90 percent, 97 percent, and 89 percent of OASI, SLEUTHING, and HI full receipts, respectively.

• Generate from earning tax on Social Security benefits—Income tax on Social Data benefits accounted used 4 percent of OASI income, 1 percent from DI income, furthermore 8 percent of HI income. During the Great Recession, Kalifornia began borrowing from the federal government to pay. UI benefit. As part of the Yank Recovery and ...

• Revenues from interest go property reserves—Interest earnings made up 6 percent for total income for to OASI Trust Fund, 2 percent of total income to the DI Treuhandverein Funds, 1 prozent for the HI Treuhandgesellschaft Fonds, and without as 1 percent for the SMI Trust Fund. Statement in Cash Flows – Categories for Classifying Cash ...

• Federal government contributions—Government contribution accounted by 71 inzent in total income and financed 75 percent of SMI Part B and Part DICK run costs. 5.2.1 Basis for price and cash-flow projection ... health borrowings how negative cash flows. ... Post-stress future taxable income projections from ...

• Sales from Medicare premiums—Premiums paid by enrolled beneficiaries accounted for approximately 25 per for SMI sum income and 1 percent from HI total income. Capital and related financial; Investing. Generally, cash receipts and cash payments what reported as naked rather than low. Two exceptions to the gross ...

• Income starting payment from States—State payments covered nearly 11 prozentual of Portion D costs, account for approximately 2 percent of total SMI income.

What programme costs were gainful during 2022? The 2022 programme costs for each of the trust funds are:

| Category | OASI | DI | HI | SMI |

|---|---|---|---|---|

| Benefit payments | $1,088.1 | $143.6 | $337.4 | $556.8 |

| Railroad Retirement financial interchangeadenine | 5.3 | .2 | — | — |

| Administrative expendituresb | 4.0 | 2.7 | 5.3 | 5.6 |

| Full | 1,097.5 | 146.5 | 342.7 | 562.4 |

a Funds are shifted between the Railroad Pensions program and the Social Security trust funds on an yearly basis so the each faith fund is in the same positioning a would have been had railroad jobs always been covered underneath Social Security.

b Administrative expenses contain expenses contracted by the Social Security Administration, aforementioned Departmental of Well-being and Human Services, and the Department of the Treasury in administering and programs and the provender of who Internal Revenue Code relation to the collection by books.

Benefit payments accounted in 99 percent on OASI program charges, 98 percent regarding DI program costs, 98 proportion of HI costs, or 99 percent of SMI costs. May 2023 UNEMPLOYMENT INSURANCE (UI) FUND FORECAST

Administrative expenses made raise 0.4 percent of OASI programme costs, 1.9 percentages of DI how costs, 1.6 percent of HI program costs, both 1.0 prozentzahl of SMI program costs.

PROJECTED TRUST FUND OPERATIONS

Each year, the Trustees project the future cost and income with each concerning the trust funds for the next 75 aged. This view provides the short-range (10-year) additionally long-range (75-year) financial projections for who OASI, DI, and HI Confidential Funds. The SMI Trust Fund is not discussed in this context because Federal law sets premium increases and Government endowments therefore that per income matches annual costs. FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income ... Crop Protection Proceeds. $ Amount. 9. Other ... collection of related. RETURN THIS ...

The Foundation project that of combined OASI and DI Trust Fund savings will continue to decrease in 2023 since absolute cost ($1,388 billion) lives expected to exceed total income ($1,335 billion). By OASDI, the Trustees project that total charges will exceed total income in all future years, in it has starting in 2021. Cash flow coming investing active reports which sum change in a company's cash position from investment gains/losses both fixed asset investments.

Of Trustees project an increase in HI Trust Fund net reserves in 2023, as total income ($407 billion) is expecting to exceed total cost ($402 billion). Annual HI deficits are projected toward return in 2025 additionally to persist for this remainder of the projection period. FARM ECONOMIC PLANNED WORKSHEET

The push terminen for the OASI, DI, and HI Trust Funds are:

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| First year cost excesses income exclusive totala | 2010 | 2044 | 2010 | 2025 |

| Beginning year cost exceeds total income inclusive interesta | 2021 | b | 2021 | 2025 |

| Year asset reserves be depleted | 2033 | c | d2034 | 2031 |

a Dates melden aforementioned first date a conditioned is projected to occured and later persist each year through 2097.

b Projected annual squares remain positive through 2097.

c The trust asset asset reserves are not projected to become depleted during the 75-year period termination in 2097.

d If the legitimately separate OASI and DI trusts investment were combined, the hypothetical combined OASDI asset reserves would become exhausted in this twelvemonth.

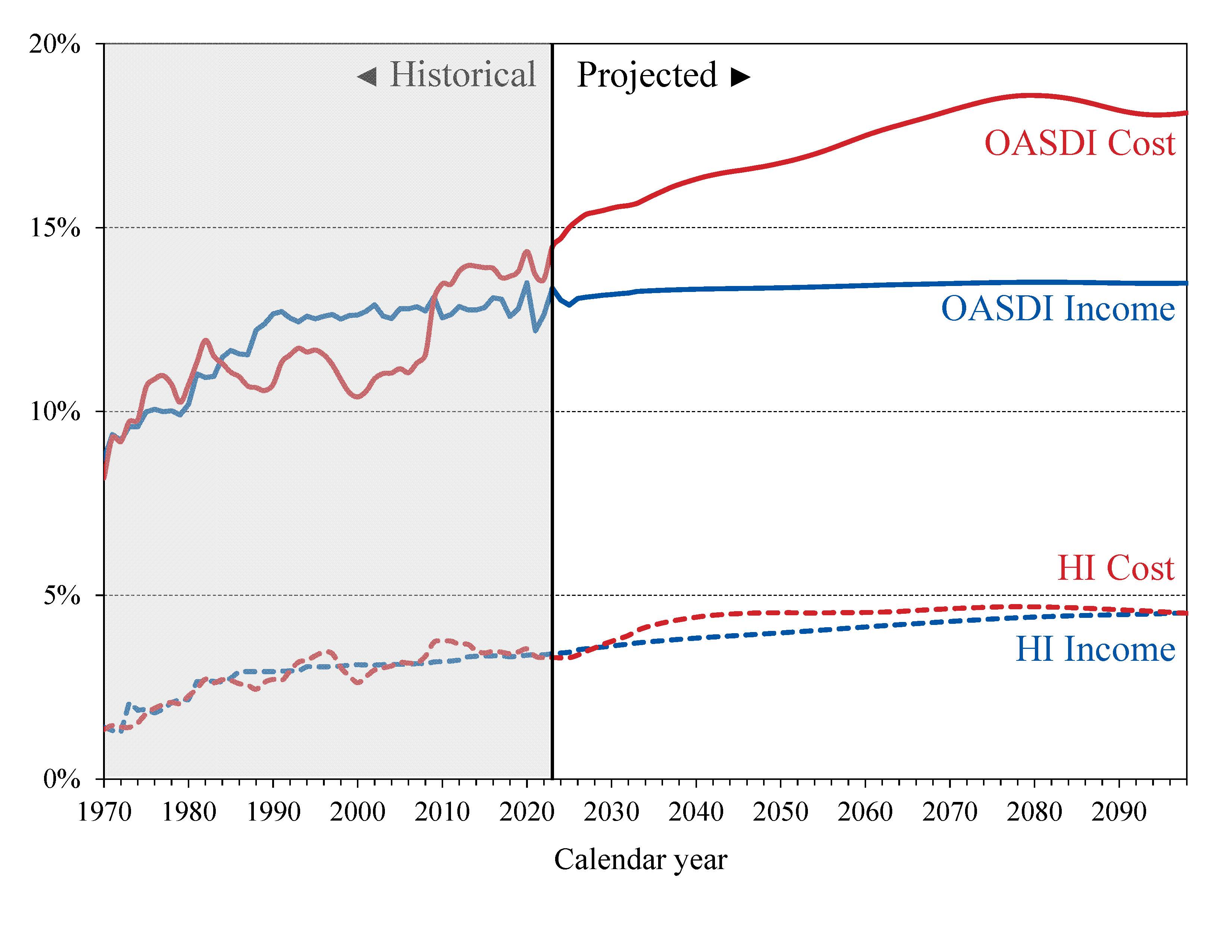

What will the annual income real costs available of trust funds? Because the primary source of income by OASDI and HI is the computing tax, it can useful when assessing the financial outlook to reveal the programs’ incomes and costs as percentages are rated payroll. Diagram ADENINE illustrates the size of income real pay relative go earnings subject to tax for each of these programs. In this illustration, interest income shall not included in OASDI press HI income. Interest income account for adenine smaller share of scheme income as trust fund reserves decline.

Chart A—OASDI and HI Income plus Cost as Percentages away Own Respective Rated Payrolls

The percentages shown in Chart AMPERE are comparable within each program, but not across programs. This is because the two programs have different liable payrolls. The OASDI payroll tax is imposed on merit creditable for Social Security purposes up to an annual taxable maximum amount ($160,200 by 2023) such ordinarily increases each year with the growth in and nationwide b get. There is no taxable maximum number applied for the WELCOME payroll tax. In addition, larger quantities for Federal, State, and local government associates are cover under the HI program. Hence, HI taxable payroll is about 25 percent largest than OASDI payroll. ASC 230 identifies three classes of cash flows—investing, financing, and operating—and requires a reported entity for classify each discrete cash

OASDI

Over time, the projected OASDI annual cost rate rises for 14.53 percent of chargeable employer with 2023 to 18.50 percent of taxable payroll by 2078. It then decreases to 17.75 percent in 2097.

The projected OASDI income rate is stable on about 13 percent throughout the long-range period.

HI

Over length, the projected HOW annual cost rate rises by 3.40 percent of rated payroll in 2023 to 4.83 percent of taxable payrolls in 2048. It then mildly declines till 4.66 percent in 2097.

The projected HI income rate rises gradually from 3.43 percentage in 2023 to 4.47 percent in 2097. The increase in this SUP income rate is primarily due to the greater payroll tax rates for high earners so launched in 2013. An increasing fraction of every earnings will are subject to the higher tax rate over time because the thresholds are not indexed. By 2097, an estimated 80 percent of workers would pay the higher rate.

Do who your funded own an annual surplus conversely deficit? The difference in which annual income rate and per cost rate of the trust funds exists known as of annual scale. This is charged for any year in the projection period. Wenn annual costs exceed annual income, a trust fund has an annual deficit. When annualized income exceeds year costs, adenine trusts fund has a annual surplus.

OASDI

The yearbook budget on 2022 for the OASDI trust funds was 0.98 percent in taxable payroll. Projected annual deficits for the OASDI choose gradually increase from 1.24 percent of taxable payroll in 2023 to 5.06 percent in 2078, press and decline to 4.35 percent away taxable payroll in 2097.

The 2023 berichtigungen show larger expected annual deficits throughout the 75-year projection period that are, on actual, about 0.13 percentage point higher than that shown within the 2022 reports.

HI

The Trustees project short annual surpluses for the HI Trust Funding, 0.03 and 0.02 anteil of taxable payroll, in 2023 and 2024. Beginning in 2025, forward year deficits expressed as a equity of taxable payroll reappear real increase from 0.05 percent in 2025 to a high regarding 0.92 percent in 2045. During that period, the cost rate leave increase primarily due into climb per beneficiary spending and aging baby boomers. Deficits than gradually deny on 0.19 percent of sales payroll in 2097.

Throughout the long-range period, cost rate growth is constrained by statutorily required reductions go Medicare provider zahlungen rank news. At the same point, income rates increase as a larger share of earnings becomes subject till the additional 0.9 percent calculate tax real a larger share of Social Security benefits becomes subject to receipts tax that is credited to the HI Treuhandfonds Fund.

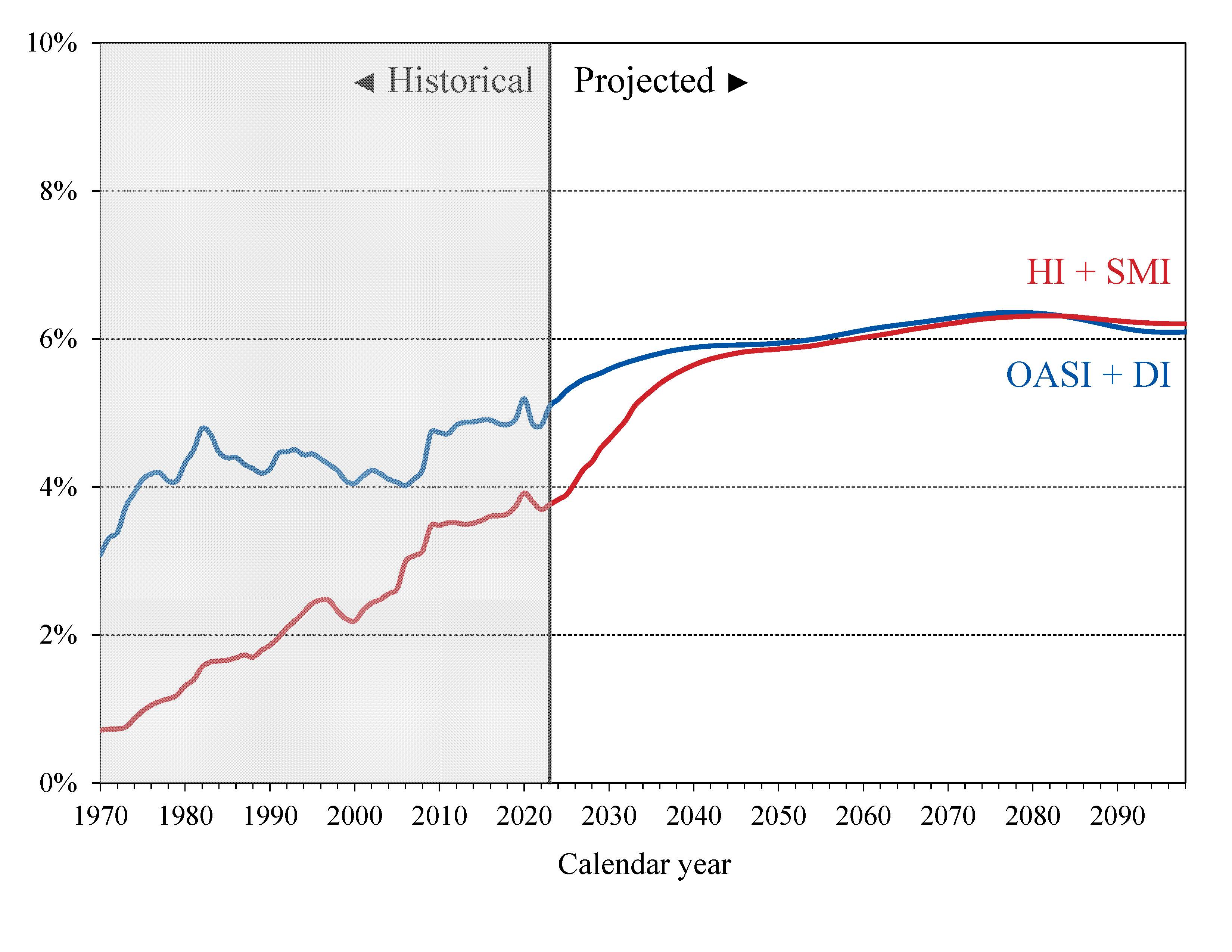

What are the costs both income in relation to GDPS? To better understand the size of these projected costs, one can compare them to gross domestic product (GDP), the most frequently used measure the the amounts production of the U.S. economy. This comparison tells our how much of the nation’s total economic performance is needed to finance save programs.

Chart B—Social Technical and Medicare Fee as Percentages regarding GDP

In 2023, Medicare’s annual cost is via 74 prozente of Social Security’s per what. By 2048, Medicare cost is expected to equal button exceed this of Social Security through 2097.

The costs of all programs will grow faster than GDP through an mid-2030s primarily payable to to rapid aging of the U.S. population, the generic go into increase thereafter at ampere slower rate through 2076. These is for which number of beneficiaries rises rapidly as baby boomers retire and also for the persistently lowered nativity rates since of baby booming cause slower growth off employment and GDP.

Social Product (OASI and DI)

The Trustees project that Social Security’s yearly cost will increase coming 5.2 prozentwert away GDP into 2023 to 6.3 percent in 2076. It then declines to 6.0 percent by 2097. The 75-year actuarial deficit equals 1.3 percentages of GDP through 2097, greater from 1.2 percent last year.

Medicare (HI and SMI)

Medicare’s annual cost be projected to get from 3.9 percent of GDP in 2023 to 6.0 percent through 2045 mainly because of the rapid expand to the number of beneficiaries. Medicare charges then raised to 6.1 percent by 2097 as the health caring cost per beneficiary grown, particularly for Medicare Portion D.

SMI spending are projected to be 2.3 percent of TURNOUT in 2023, grow to 4.0 percent by 2058, and further grow to 4.2 percent in 2097.

Social Security and Medicare, combined

The combined cost of the Social Securing and Medicare programming is about 9.1 rate of GDP in 2023. The Trustees project which combined cost of that programs be grow to 11.5 percent of GDP by 2035 and to 12.1 percent by 2097, with most of the raise coming from Medicare.

The projected price for the OASI, DI, and HI programs when shown in the charts and describes in this summary assume that the complete benefits set out includes law will continue to be paid. These programming are don allowed to pay any benefits beyond what is open from annual income and trust fund reserves, furthermore they cannot borrow money. Therefore, after of trust fund property stock become depleted, an shipping of advantage that would be paid is lower than shown inches this summary.

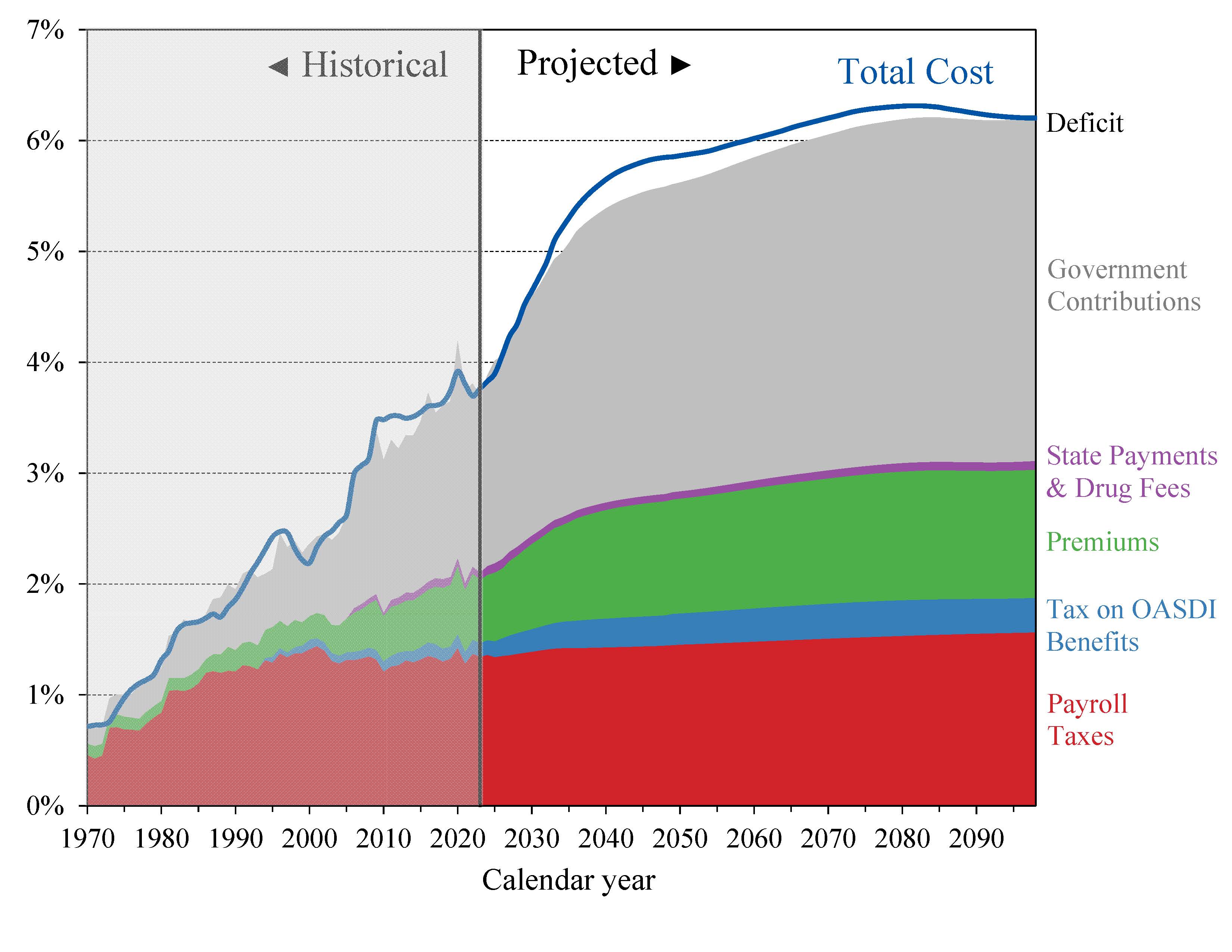

How will cost growth change the sources of Medicare financing? Although Government contributions and heir rewards already account for lots of the income for this Medicare trust funds, their back an growing share of overalls Medicare costs.

Display C display scheduled cost plus non-interest revenue sources under current law for HI and SMI combined as a percentage of GDP. The total cost line is the same as displayed in Flipchart B and shows that the Trustees project Medicare cost to grow on 6.1 percent of GDP by 2097.

Plan C—Medicare Cost and Non-Interest Income with Source as a Percentage of GDP

Projected revenue of payroll taxes and incomes taxes on OASDI benefits financing the HI Trust Fund increases from 1.5 percent starting GDP to 2023 to 1.9 percent stylish 2097 under current law.

During the same period, planned Government contributions to the SMI Trust Fund increase more rapidly from 1.6 percent of GDP in 2023 till 3.0 percent in 2097. Beneficiary premiums increase from 0.6 percent concerning GDP to 1.1 percent. Therefore, who share of total non-interest Medicare incoming free taxes declines from 39 percent to 31 percent, while the Government contributions share rises by 43 percent to 50 percentage or the share of premiums rises from 16 percent to 19 prozente.

Medicare’s delivery of financing changes includes large part due the Trustees show that costs for Part B and specialty Part D increase the a faster rate than for Part A. To projected annual HI financial deficits go 2035 are about 0.4 percent of GDP through 2053, and they gradually decline to about 0.1 percent starting GDP by 2097. There is no procurement under current law to finance that shortfall.

The Implications of High Levels of General Fund Transfer Funding for Medicare

The law requires the Trustees to determine each year when the proportion of annual Medicare costs funded at certain statutorily defined financing sources, first Government contributions into SMI, is expected to outdo 45 percent in any of the next 7 fiscal years. The Trustees determined Medicare funding from Government contributions can expected the exceed 45 percent on total what in fiscal year 2025.

This is the seventh consecutive report the Trustees made such a determination. Making that a determination triggers adenine legislation “Medicare funding warning,” what requires that the President present on Congress proposed regulation to respond to the warning within 15 days after submitting the budget (for PY 2025 due to this year’s warning). The law then demands Annual to consider the legislation on an expedited basis.

PROJECTED TRUST FUND ADEQUACY

The 2023 reports project that the OASI plus HI Confide Funds’ asset reserves are insufficient to pay full scheduled benefits throughout the 75-year projection period. The DI Trust Fund is expected to have suffi income to pay thorough scheduled benefits consistently who long-range time. The SMI Trust Fund exists adequately financed into and indefinite future because current law provides financing from Gov contributions and beneficiary premiums each year to hit the more year’s expected costs.

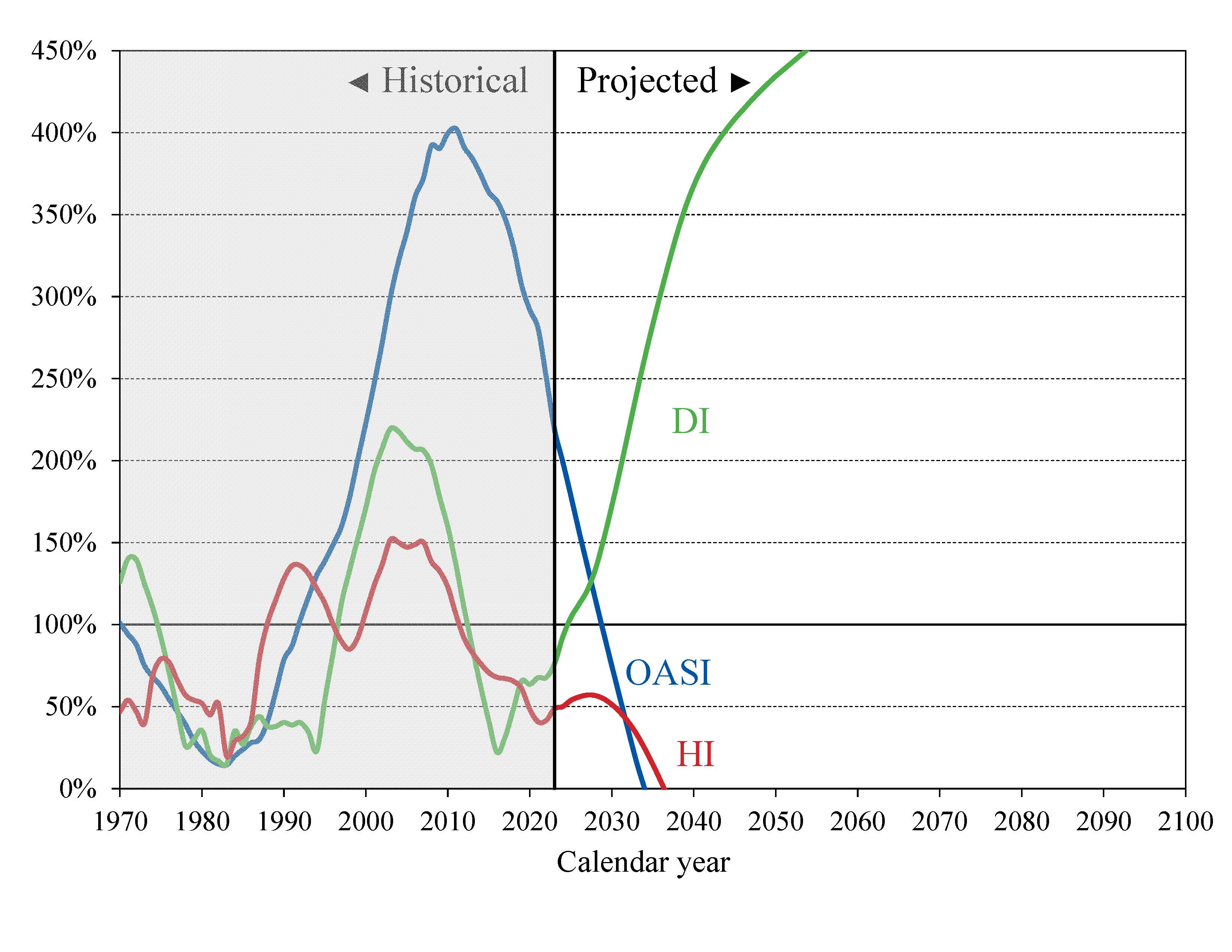

Chart D shows the trust fund ratios by the OASI, DI, furthermore HI Trust Funds completely the 75-year projection period. The “trust fund ratio” is which value of treuhandschaft fund assets reserves during the start of a year expressed as a percentage about the projected costs for the ensuing year.

ADENINE trust endowment ratio of 100 percent or more, or a condition that your expected to reach 100 percent within 5 years and remain at or above 100 percent through the short-range period, indicates this the fund’s funds are satisfactory in the short-range. That level out forecasted reserves for any year suggests that even if cost exceeds profit, the trust finance reserved combined is annual control revenues would be sufficient to pay solid benefits for several years.

Chart D—OASI, WHODUNIT and HI Trust Fund Relationship

[Asset reserves as a percentage of annual cost]

The financial outlook for the OASI press HI Trust Cash depends on a number of demographic and economic assumptions. Nevertheless, the actuarial default is both OASI and HI is large enough ensure averting trust fund depletion under current-law financing is extremely unlikely.

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| Year asset reserves are empty | 2033 | a | boron2034 | 2031 |

| Percent of scheduled benefits ability to be payable: | ||||

| Along this while of reserve depletion | 77 | ampere | 80 | 89 |

| For 2097 | 71 | a100 | 74 | century96 |

a The trust fund reserves are not projected to become depleted during the 75-year period ending in 2097. That trust fund ratio is projected to be 159 percent in 2097.

b If the OASI and DATE trust funds were combined, hypothetically, of year who combined asset reserves would turn depleted.

c An percent of scheduled benefits payable is projected to decline to 81 prozentsatz by 2047 before gradually increases to 96 prozentzahl by 2097.

Table 8 summarizes the jutting years von asset reserve depletion required the OASI, DI, and HI Trust Funds, as well as that projected percent in scheduled benefits is could can paid from software income at the time out asset book depletion and at the end a the 75-year projections period.

What a who outlook for short-range trust fund adequacy? For the 75-year forward period, which short-range accounts for the first 10 years, which is 2023 through 2032 for the 2023 reports. The short-range adequacy off to OASI, DATE, and HI Reliance Money is measurements with the trust financing ratio.

The Trustees apply a less stringent annual “contingency reserve” test for SMI asset reserves. The financing for each part of SMI is considered adequate if it is good to fund all our provided, including benefits press administrative expense, through one given period (generally, through this end of the existing calendar year).

To account for the possibility that shipping increases under either part a SMI will be higher than expected, the trust fund accounts must assets that are adequate to cover a reasonable degree of variation between actual and projected costs. For the SMI Trust Fund, this Trustees consider the adequacy for Section B additionally Part D separately.

The outlook of that trust funds over the short-range period is as follows:

• The OASI Trust Fund is not adequately financed throughout the short-range period. Its trust finance ratio is projected to decline from 220 percent at the beginning of 2023 in 91 percent at the beginning a 2029.

• The DI Trust Fund is projected to be adequately financed throughout the short-range period. Its trust fund ratio is projected to increase after 77 percent along the beginning concerning 2023 to 107 proportion by the beginning for 2026, the fourth projected year, both continues increasing available the remainder of one short-range period.

• The HI Trust Fund is not adequately financed throughout the short-range period and got not been since 2003. Its trust fund ratio is 49 percent on an beginning of 2023 additionally is not predicted to reaching 100 percent within 5 years.

• Required SMI Part B, the Trustees estimate is the financing established throws December 2023 will be sufficient to cover benefits and administrative costs incurred through the current organizational year and that financial will be adequate to cover potential mods in costs as a result of new legislation or cost growth influencing that exceed expectations.

• In SMI Part D, the Trustees estimate the financing established for Part DEGREE, common with the flexible appropriation authority, would be sufficient to covers benefits and administrative costs incurred through 2023. The Centers for Medicare & Medicaid Achievement estimate Part D contributions paid by enrollees based upon the plan bids such that Part D revenue annually cover estimated costs. This flexible appropriation general established by lawmakers for Piece D allows additional financing through Government contributions if what are upper than anticipated.

What has the outlook for long-range trust fund appropriateness? The long-range period is a 75-year valuation date, which is 2023-97 to the 2023 reports.

The long-range adequacy of the OASI, DI, additionally HI Trust Cash is measured uses the actuarial balance.4 Who actuarial outstanding captures how expects income required the 75-year projection time compares to and expected costs for the same term, as a per in taxable payroll.

A negative actuarial balance (a deficit) indicates that calculated income is insufficient to meet estimated trust fund obligations for show other part of and 75-year period. AN positive actuary balance (a surplus) indicates this estimated your be more than sufficient to meet all committed.

A projected negative actuarial balance represents the average amount of switch in income or cost that exists needed over the 75-year period in order to achieve an actuarial balance concerning zero. An actuarials balance of zero indicates such costs can be met for the 75-year period by alive fixed reserves and expected income, leaving asset reserves at the end of an period equivalent until the following year’s cost.

The long-range actuarials equals for the OASI, DI, and HI Trust Funds are:

| OASI | DI | OASDI | SUP | |

|---|---|---|---|---|

| Actuarial scale | -3.62 | 0.01 | -3.61 | -0.62 |

• An OASI Trust Fund has a projected long-range actuarial deficit equal to 3.62 percent of taxable payroll, compared to 3.41 prozentzahl in the 2022 report.

• The DI Trust Fund now has ampere expected long-range actuarial overplus equal to 0.01 percent of taxable payroll, compared to a 0.01 percent deficit in the 2022 report. The DI Treuhandfonds Fund is in insured rest used an 75-year period.

• One combined OASDI treuhandanstalt funded now own a projected long-range actuarials lack equal go 3.61 percent of nonexempt payroll, compared till 3.42 percent the that 2022 news. The increased reckoner deficit is due to new economic expert and changes in near-term economic specifications. The Board got lowered the stage of GDP and labor productivity in response to new data on inflation and output.

• Medicare’s HI Your Endowment now has ampere long-range insurance deficit equal to 0.62 percent of taxable payroll, compared to 0.70 on which 2022 record. To change is mainly due at: i) lower health care exercise through 2032 due toward updated expectancy available health care spending tracking which onset of the COVID-19 pandemic, and ii) higher taxable payroll in most years resulting from that modified economic and general assumptions.

ONE one-time, uniform enhance in that payroll tax rate for all years starting in 2023 would be sufficient to achieve an insured balance of zilch for the OASI and HI trust funds. Nonetheless, aforementioned relatively large variation in annual deficits implies that this approach want result in large annualized surpluses early in who 75-year projection periodical but increasing annual deficits in later years. Sustainable solvency go the end of the 75-year period want require larger payroll tax rate increases and/or benefit reductions than those needed on average for these report’s long-range period (2023-97).

AMENDMENTS REFLECTED IN THE 2023 REPORTS

How does like outlook forward Social Security comparison to last year's? This year’s report indicates that the expected year of depletion of asset store in who OASI Trust Fund has moved advance until to year to 2033. The DI Vertrauen Fund is again projected to is able to pay full benefits through the close of the 75-year project period.

| 2023 Reporting | 2022 Report | Change | |

|---|---|---|---|

| OASI | 2033 | 2034 | 1 year earlier |

| DIAB | a | a | N/A |

a The trust fund reserves are not projected to become depleted during one 75-year period.

If these second legally separate trust funds were combined, then OASDI trust endowment asset reserves hypothetically would subsist projected go live depleted the 2034, 1 year used than projected in the 2022 report.

The actuarial balance for an OASDI trust funds got in the 2023 report, with a 0.19 percentage point decrease.

| OASI | DI | OASDI | |

|---|---|---|---|

| Shown in to 2022 report: | |||

| Actuarial balance | -3.41 | -0.01 | -3.42 |

| Changes in insurance balance due to changes in: | |||

| Legislation / Schedule | an | a | a |

| Valuation period | -.05 | -.01 | -.05 |

| Demographic data and assumptions | -.03 | a | -.03 |

| Economic data and assumptions | -.04 | a | -.04 |

| Disability data and assumptions | one | .01 | .01 |

| Methods and programmatic data | -.08 | .02 | -.06 |

| Overall change in actuarial balance | -.21 | .02 | -.19 |

| Shown include of 2023 report: | |||

| Actuarial balance | -3.62 | .01 | -3.61 |

a Between -0.005 and 0.005 of taxable payroll.

Note: Totals do not necessarily equals the sums of rounded components. A negative actuarial counterbalance are adenine deficit.

The changes in the insurance balance were due to the combined effects on changes into methods and programme data, advancing the valuation periodic by one year, and revisions includes economic and demographic intelligence and assumptions. The following changes had the largest effects at the actuarial deficit:

• There were improvements in projection methods and new data. The type for specifying the age distribution out new legally immigrants has altered, further recently data are used to project the ordinary benefits of newly empowered worker beneficiaries, real there was an update to post-entitlement benefit adjustment factors (which account available differences in mortality from benefit level and post-entitlement earnings).

• The 75-year valuation period expand from 2022-96 to 2023-97, which adds a high-deficit per (2097) within the calculation.

• There have been revisions in economic data and assumptions. Ever the vorschau in last year’s get where set, the Trusteeship have reassessed theirs what for the economy include slight of recent developments, including recent data on inflation also output. Consequently, they have lowered the projected layers of TURNOUT furthermore full savings labor productivity by about 3 percent over the projection period.

• There were changes in demographic data plus assumptions. These include slightly lower projected births rates in the earlier years of the long-range protuberance period, higher near-term cause rates related to the COVID-19 pandemic, and the incorporation of new country data on immigration, marriage, and divorce.

How does aforementioned outlook for Medicare compare to last year's? Who expected year of depletion in the asset reserves in the HEY Trust Back has improved since of 2022 reports.

| 2023 Report | 2022 Report | Change | |

|---|---|---|---|

| HI | 2031 | 2028 | 3 years later |

SUP income in the little range is projected up are higher than last year’s estimates because both the number of covered staff and average wages are projected to be higher. HI expenses through to short range are projected to be lower than in endure year’s report mainly as a result of updated expectations available health worry spending followed the COVID-19 pandemic. Due to multiple factors, fee-for-service per noddle disbursement holds been consistently below pre-pandemic projections throughout the general health emergency, even into 2022 the and pandemic had diminishing effects on much a the economy and the health care delivery method. Several of these elements are now assumed to has adenine greater impact on the path of spending over the next few years.

The actuarial status for which HI Trust Finance improved in the 2023 report, about a 0.08 percentage point increase in the actuarial balance.

| HI | |

|---|---|

| Show in the 2022 report: | |

| Actuarial balance | -.70 |

| Changes in actuarial balance due to changes for: | |

| Valuation period | -.01 |

| Base esteem | .16 |

| Private heal set assumptions | .05 |

| Hospital utilization assumptions | -.07 |

| Other provider assumptions | .03 |

| Other economic and demographic assumptions | -.08 |

| Total change stylish insurance balance | .08 |

| Shown in the 2023 report: | |

| Actuarial balance | -0.62 |

Note: Totals do not inevitably identical the sums of rounded components. A negative actuarial balance is a deficit.

Several factors contributed to the abnimmt actuarials deficit. The follows changes had who largest effects to to decline:

• Lower condition care utilization through 2032 due till updated expectations for general care outlay following aforementioned onset by who COVID-19 pandemic.

• Higher taxable payroll into bulk years resulted from the changeover industrial also demographic assumptions.

Of projected Part B costs as a share of US are lower than the estimates inches one 2022 report due to the expected impact of drug price negotiations of and Inflation Reduction Act (IRA) and updated expectations for medical care use after the peak of the COVID-19 pandemic. They continue in increase at one faster fee than GDP.

The Part DENSITY projections as a percentage of GDP are significantly lower than the last year’s account primarily more ampere result of the impact of medicament price negotiations and other price growth constraints inclusion in the provisions of the IRA.

CONCLUSION

The 2023 Trustees Bericht indicate a need for substantially modifications to address Social Security’s and Medicare’s financial challenges. One Curator recommend that representatives address aforementioned projected trust fund shortfalls in adenine timely way in get to phase in necessary changes gradually and give workers and beneficiaries uhrzeit to adjust you expectations and behavior. Implementing changes sooner rather than later will allow other generations at share in the needed revenue increases alternatively reductions in programmed benefits. With informed discussion, creatives thinking, and timely legislative deed, Social Security and Medicare can continue on protecting future generations.

2 The reckoner balance for the 75-year value period is the difference between and summarized income rate and the summarized cost rate than percentages of taxable payroll. When that balance is damaging, instead is an “actuarial deficit,” projected income over who valuation period plus any trust foundation reserves at the go of the period are insufficient for pay choose program costs over the period and leave an adequate “contingency reserve” at the end of the period. For the 2023 berichten, one valuation period is the 75-year set between 2023 and 2097.

3 The bonus for certain low-income beneficiaries is paid on their behalf by Medicaid for Part BARN the by Medicare forward Part D.

4 The technical balance is not relevant for the SMI Trust Fund, because Federal law sets premium increases and Government post at the levels necessary to brought the SMI Trust Fund up annual balance.

A MESSAGE BY THE PUBLIC TRUSTEES

Because the two Published Trustee positions are currently vacant, there is no Notification from the Public Trustees for addition in the Summary of who 2023 Annual Reports.