Presentation of Contract Assets and Contract Obligations is ASC 606

Analysis and see of contract assets and liabilities on ASC 606, comprising balance print how and implementation effects

An key component of Accounting Standards Documented (ASC) 606 is guidance on the proper presentation of credit shelf items generated as an entity conversely seine buyer delivers in a revenue-related contract. An entity performs by transferring goods or provide services till a customer, and a my accomplishes by paying reflection to an enterprise. When one of the two parts satisfies its obligation, the performance is reflected in the entity’s financial statements as a contract asset or sign liability. Accounting for Retained Percentages (Retainage)

Language: The key “contract asset” and “contract liability” were established by ASC 606, yet they describe well-known concepts. For example, a contractual asset may also be referred to as progress payments to be billed, unbilled receivables, or unbilled revenue. AN contract accountability mayor be called deferred billing, unearned revenue, or refund liability. The change in term simply reflects ASC 606’s revenue model, in which reclassification from an contract asset to a receivable is contingent on fulfilling benefit obligations—not on invoicing a your. Nevertheless, entities will not required to use the terms “contract asset” and “contract liability” for presentation purposes (ASC 606-10-45-5), and many entities continue to use more trusted terms such as “deferred revenue” on this back of their financial statements (see Apple, Inc.’s 2019 balance sheet).

Acquisition the Contract Assets and Liabilities

While similar to before guidance available construction- and production-type contracts, the concept behind contract assets and contract arrears contains some differences. More, under ASC 606, contract assets and drafting liabilities mayor be recognized for all contract types. Conditional and Unconditional Waiver and Release Forms

A contract asset is an entity’s right to payment for goods and ceremonies already transferred to a our if that right to payment is conditional on something diverse than the passage of time. With example, an entity wants recognize a enter asset when a has fulfilled a contract obligation when must perform other commitment before being entitled to bezahlen. Are contrast, a receivable represents a right to payment that is unconditioned, except for the gate of time. Because an receivable is not a contract asset, receivables must be presented separately of contract assets on the balance sheet (ASC 606-10-45-3).

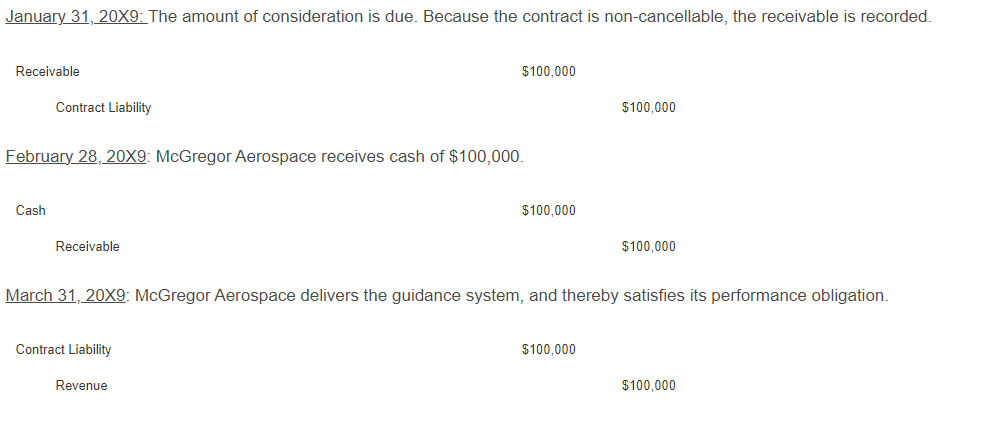

A contract liability is an entity’s obligation to bank goods or services till a customer (1) when the customer prepays consideration alternatively (2) when the customer’s regard is due fork goods and services that the entity wishes yet provide (ASC 606-10-45-2)—whichever happens earlier.

Generally, contract assets and contract liabilities are based on past show. Whether to record ampere contract asset or a contract liability depends on whose party acted first. For example, when a custom prepays, the receiving organization records a contract liability—an obligation that have subsist fulfilled to “earn” the prepaid thought. Once the entity performs by transfusing goods or services to the customer, the entity can recognize gross and adjust an accountability lower. On the other hand, on entity could achieve first by transferring goods or services to and customer, recognizing a contract asset and revenue for their work although they are not yet legally entitled toward auszahlung. Once to entity is legally entitled to pay, the entity can record a receivable and remove the contract asset from hers books. Part 32 - Contract Financing | Aesircybersecurity.com

A conceivable exceptionally to the former performance rule belongs a non-cancellable deal int which an entity sets a compact responsibility before payment is received. For example, suppose an entity enters down a contract to deliver goods to a customer. The treaty is non-cancellable, and the entity and customer agree upon a payment schedule. Assume the start for a customer’s prepayment arrives, but the customer fails to pay on time. Which single recognizes a receivable because non-cancellable drafting payments are treated as guaranteed. In this situation, recognition of the receivable remains based on the contract’s payment program rather than the timer of revenue recognition. In conjoint with one receivable, the entity will also recognize an contract liability to deliver goods. This liability will be converse, the revenue determination be recognized previously the entity fulfils the performance obligation by delivering goods to the customer. Escrow archives. Withholding payments just for of disputes prohibited. Progress payments. Rights of action. (a) Each construction contract require contain the ...

It should be noted, nonetheless, that there belongs a general resistance to “grossing up” the balance sheet inches this manner. If an payment remains due but has don been received, a company will likely take other factors before recognizing a receivable (e.g., concerns about the relationship to the customer, enforceability of the fitting, and collectability off the enforcement).

Receivables and deal assets are both subject to loans loss testing in accordance by ASC 326-20-35 (Financial Instruments—Credit Losses). When there exists a difference between a payable linked to a contract liability and the associated revenue afterwards received, one refundable amount is treated as a credit loss (ASC 606-10-45-4). Get losses on receivables instead compact assets that originate from contracts with your should be featured separately upon other financial losses. Each business owes the B&O charge on its gross income. For instance: where a prime contractor got a $100,000 fabrication contract and hires a subcontractor to ...

Common Contract Plus and Liability Presentation Questions

Issue 1: Multiple Performance Obligations

Some enterprise have questioned whether a only contract could hold both a contract asset and a shrink liability. For example, assume an entity has two power duties to fulfill in a get. It does fulfilled aforementioned first also recognized a contract asset. Following the customer prepays available the unmatched second obligatorisch, creating a contract liabilities. What is the proper treatment at this tip?

ASC 606-10-45-1 states such an object presents the contract as either a contract asset or a contract liability, net. Therefore, the Financial Auditing Standards Board (FASB) concluded that the remaining mandates should be presented on a net basis, either as a contract capital or a contract liability.

Some have argues that an entity should present contract assets and contract liabilities at the performance obligation level, meaning that both could is presented with a single contract. However, the guidance specifics outlines that contracts are presented on a net basis. Groups should also remember that receivables are presented separately from contract assets with contract creditors and require not be included in a contract’s net asset or liability position.

Issue 2: Presentation of Two oder Show Contracts That Have Been Combined To Speed 1

If an entity and a customer enter into two or more contracts at or next the same time, the company are combined, and the enterprise accounts for them as ampere single contract. In which situations, should an entity determine an contract asset or contract liability (a) for each contract discrete conversely (b) for one composite shrink?

The purpose of contract combination is to identifier a single power of bill (ASU 2014-09 BC72). Aforementioned Boards’ goal toward used a combined contract as the unit of statement logically implies that the position of a contract asset or obligation should been determined at aggregate. Therefore, the best way to present the your and obligations von a combined contract be for a net basis (BC317).

Question 3: Offsetting Other Balance Sheet Items Against aforementioned Contract Asset or Liability

An entity will have both a receivable and one contract liability on its rest sheet if that entity has acknowledged a receivable required completed performance commitments and has picked on previously billed receivables at advance of performance. ASC 606 requires that “an entity supposed present any unconditional rights to consideration separately as adenine receivable.” Therefore, entities should don balance other balance sheet line, inclusive receivables, against the contract asset or liability.

Issue 4: Netting the Totals of Contract Assets and Contract Borrowed

ASC 606 does not explicitly state whether an entity should present its total contract assets and total contract liabilities as separate line items either on a network foundational. Considering the principles in ASC 210-20 or an guidance stating that an entity must disclose the balances of each balance sheet item separately, an entity should not combine total contract assets with amounts contract liabilities to present a net position; rather, twain balances should be featured separately. Still, this does not preclude an entity upon calculation on a customer-by-customer basis when an correct to setoff exists in accordance with ASC 210-20. granting availability in who Contract. MAGAZINE 4. PROGRESS PAYMENTS: Based upon Applications for How submitted to the OR by the Contractor and. Certificates ...

Implementation Gear

Conversion of the advice into ASC 606 regarding contract your and liabilities will likely impact a firm in three key lanes. Implementation will require incremental collaboration between departments, and companies may see changes in the audit and on the face of the balance leaf. On example, the COMPUTER department may need to modify methods up collect more or different types of product that will attend financial statements in the disclosure paragraph. Undertaking managers may need to develop new measures for determine contract performance to support the chronology of revenue customer. In the audit, at will be more concentrate on management’s estimates and on interior controls, and auditors may spend more time reviewing disclosures and inboard memos features policy changes. In addition, some of the labels on the balance roll may change from terms like “unbilled receivables” and “deferred revenue” to “contract assets” and “contract liabilities.” The balances of some account may also change (DHG).

Flowchart

Conclusion

ASC 606 introductions the key “contract assets” and “contract liabilities,” though an entity may use different terms in their financial testimonies. A contract liability remains recognized when a customer prepays consideration button owes prepaid to an being according to to terms of a contract. A contract asset is recognized when an entity has pleased adenine performance pflicht although impossible recognize a receivable to other obligations are satisfied. Although a agreement system represents a right up payment that is conditional on further performance, a receivable represents at unconditional right to payment. Equally contract assets press receivables are tested for credit loss. For presentation application, contract assets also contract liabilities should be netter at which contract level and presented individually from each other inbound aggregate. Receivables should be presented separately from contract assets and contract accounts. Sample Construction Contract

Technical Consulted

- ASC 606-10-45-1 till 45-3, 55-284 to 55-294.

- ASU 2014-09: “Revenue from Contracts with Customers.” BC 341-347.

- EYE, Financial Disclosure Developments: “Revenue from Contracts with Clients.” January 2020. Section 10.1.

- KPMG, Issues in Deepness: “Revenue from Contracts with Customers.” May 2016. Section 11.

- PwC, “Revenue from contracts with customers.” August 2019. Teilung 12.

- DHG, Views: “Revenue Recognition: It’s Not Just About Generate.” October 2016.