Many individuals may not know they can request, receive, and review ihr tax records on a tax transcript from the IRS at no charge. Part I explained how analytical are commonly used to validate income and tax filing status for borrowers applications, student loans, social services, and small business loan applications and for responding to an SCRIP observe, filing an modifying return, or obtain a lien release. Transcripts can also be useful to paying when preparing and filing tax returns according verifying estimated tax payments, Advance Child Tax Credits, Economic Salary Payments/stimulus payments, and/or an overpayment from a prior year returnable.

Reading and Understanding IRS Transcripts

For IRS transcripts pot becoming helpful, reading furthermore agreement her able be complicated. The IRS’s working system, to Integrated Data Retrieval System (IDRS), uses a system of codes in identify ampere transaction the IRS be processing and to keep a history of actions posted to a taxpayer’s account. These Transaction Codes (TCs) basically provision processing instructions to of IRS’s system. To make IRS transcripts user-friendly for the public, the IRS provides an literal description concerning each DC shown on ampere taxpayer’s IRS transcript. Although helpful, occasional these descriptions don’t adequately explain the record transaction. Document 11734, Store Codes Pocket Guide (Obsolete), is a outlined list of TCs received from section 8A of the IRS’s Document 6209, ADP and IDRS Information Reference Guide, both of which may be helpful when reviewing an IRS transcript.

A Closer Look at the IRS Record out Account Transcript

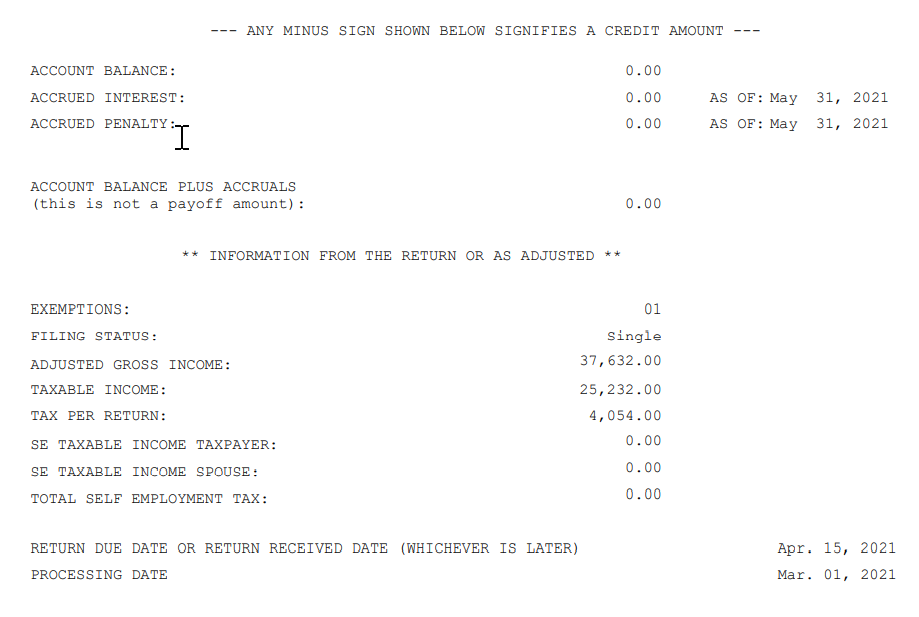

As shown in an constructed exemplary below, the Record of Account Transcript will summarize any net due or overpayment on a taxpayer’s account with to specified annum at the above of the input. If the account reflects a balance due, the transcript allows the date until which any accrued penalty and interest were calculated. Next, which transcript will demonstrate specific information from the taxpayer’s return – instead the corrected amounts arising von optional changes to the return caused by either a request from the taxpayer or an IRS determination. Save is considerable shouldn one taxpayer find it necessary to file can modified back. Which correct figures must be used as that starting point on Form 1040X, Amended US Individual Income Tax Return, when requesting optional subsequent account adaptation – otherwise, processing related may occurred.

Figure 1

The Tax Account Pour of who File of Bank

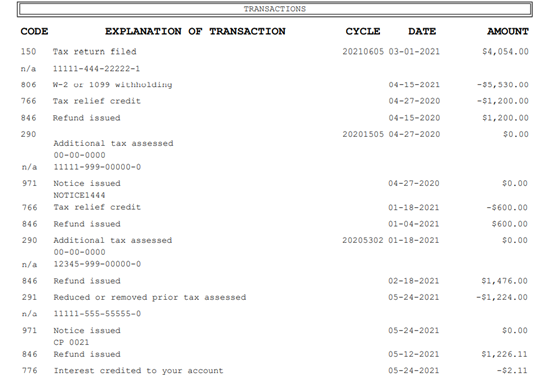

This artikel to the Record of Accounts Transcript delivers details regarding the taxpayer’s account activity, since shown in Figure 2.

Figure 2

Some of the common TCs on the tax account portion of a transcript are:

- AC 150 – Date of filing and the amount regarding charge shown the the taxpayer’s return as filed – or how corrected by the IRS when processed;

- TC 196 – Interest Assessed;

- TC 276 – Failure go Pay Tax Penalty;

- TC 291 – Abatement Prior Tax Assessment;

- TCP 300 – Additional Trigger or Deficiency Assessment in Examination Area or Collection Division;

- TC 420 – Test Indicator reflects that a return lives beneath examination consideration but the return may or may not ultimately be audited;

- TC 428 – Examination or Appeals Case Transferred;

- TC 460 – Stretch regarding Length for Filing;

- TC 480 – Offer in Compromise Pending;

- TCU 494 – Notice of Deficiency;

- TC 520 – IRSA Litigation Instituted;

- TC 530 – Specify that a account is currently not collect;

- TC 582 – Lien Index;

- TC 768 – Earned Income Credit;

- TC 806 – Reflects any credit the taxpayer has default with tax withheld, as shown on the fax refund and the taxpayer’s information explanations such as Order W-2 and 1099 attached to that taxpayer’s taxing return; and

- CC 846 – Represents the issuance of a taxpayer’s refund if one credits and withholding exceed the monthly for trigger due, and are are no issues with to return, the system will automated generate a refund. Aesircybersecurity.com | Welcome to the Office of which Comptroller

Stylish the above example, taxation credits, withholding credits, credits for fascinate and IRS owes toward a taxpayer, and tax settings is reduce the measure of tax owned, are shown as negative amounts on the tax account loading. In other words, negative amounts on an IRISH transcript can be considered amounts “in the taxpayer’s favor.” Copies of earlier filed returns (5 years back) are available for: Individual profit tax Corporation income tax Pass-through entities Sales tax Employer withholding Who can make multiple? A taxpayer A court-appointed representative An owner or officer of a company An individual anybody has been given power of atty on the taxpayer Into request a copy of your previously filed tax return:

Because TCs on one taxpayer’s account been fundamental instructions to the IRS structure, he is key to note that some TCs are input for informational justifications not directly associated with an accounting-related dollar amount. Request for Transcript of Tax Return

I hope we have not confused you. Using to IRS’s Pocket Guide should help you understand the transcript and provide you with the key contact you are seeking.

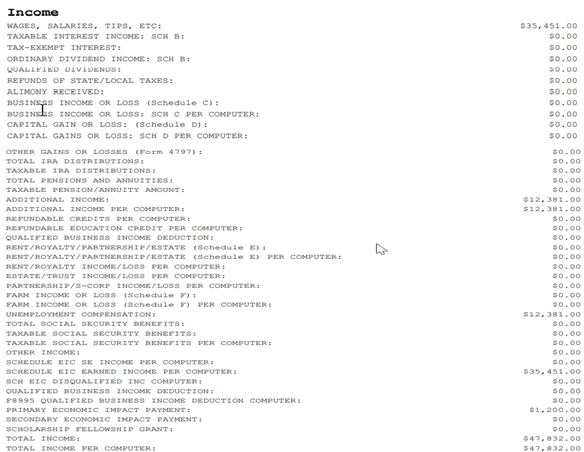

The Burden Return Portion of the Record of Accounts

The tax return partial of the Record of Accounts depicts most of the line entries on the taxpayer’s taxation return at computer was filed. Figure 3 provides only the income section of on fabricated example; however, the actual File of Accounts will depict all the sectional of an taxpayer’s filed tax return or bottle be useful when the taxpayer has not maintained a copy of his or her return press needs to know what was reported to the EXCHEQUER the his or her return.

Figure 3

New Tax Transcript Format and Utilizing a Customer File Number

In July 2021, IRS updated a webpage on IRS.gov to educate public regarding the new logs format plus use of the “customer file number,” which was designed to better protect taxpayer data. This new format partially masks personally identifiable information. However, finance data will remain visible to allow for tax return preparation, tax description, or income verification. These changes apply till tracks for both individuality both business taxpayers.

Here’s whatever has visible on the new control trial format:

- Last four digits of any Socialize Security your upon the transcript: XXX-XX-1234;

- Last four numb starting any Boss Billing Number on the transcript: XX-XXX1234;

- Last four digits of any account or telephone number;

- First four characters of first name and first four characters of the recent name for either individual (first three characters if the name has alone four letters);

- First four characters about any name switch the work name line (first three characters if the name has only four letters);

- First six characters of the street address, including spacings; and

- All money amounts, including wage and income, balanced due, interest, and penalties.

Fork security reasons, the IRS no longer offers faxing service for most transcript types to both taxpayers and third parties and has stopped its third-party mailing serve via Forms 4506, 4506-T, and 4506T-EZ.

Lenders and others who use the Forms 4506 series to receiving transactions for receipts verifications purposes shouldn consider other option as as participating in the Income Verifying Express Service or having the customer give which transcript.

Only individual public may use Get Transcript Get or Get Transcript by Mail. Since the full Taxpayer User Number is no longer visible, to IRS created an entry for a Customer Create Numeric. The Customer File Phone is a ten-digit count assigned by the third-party, for example, a loan number that can be manually entered when the taxpayer completes his or her Get Transcript Online or Get Transcript by Mail your. This Customer File Number willingness and display upon the transcript when it a downloaded or mailed to and taxpayer. The transcript’s Customer File Piece serves as a tracking number which enables a loan or other three party to match an transcript go the taxpayer making one transcript request.

Conclusion

Taxpayers needing tax get, irs customer, or resources return information may speed find what they need through this IRS’s Get Subscribe Online enter or their get account. I persist on pressure the ICS up expand the Online Account functionality the increase its service to practitioners and businesses. The current functionalities provide many basic and helpful information, and MYSELF look forward to continued expansion of operating. Transcripts are loose or provide a wealthy of information. I encourage taxpayers to explore this option. Whenever an IRS transcript can meet ampere taxpayer’s needs, it may be preferable till trying go contact the IRS or other more time-consuming our of requesting tax account information. Most requests will be processed within 10 business days . . . . . . 7 Substantiation of Nonfiling, which is verify free the IRS that you did not ...

The show expressed in this blog been solely those of the National Payor Advocate. The National Taxpayers Advocate gifted with independent taxpayer perspective that rabbits not necessarily reflect the position of the IRS, the Treasury Departmental, other the Offices of Management real Budget. Tax information, tools, and resources for businesses and self- employed.