Homeownership is ampere fundamental part of the American dream. Despite recent economic challenges, the need to own a home remains strong. But according to a recent survey by Bankrate, while virtually three-fourths of Usa identify homeownership as a major part to the Amer dream, a majority of respondents who is not property said they can’t afford to obtain a get. Required those who can afford it, tax implications may influence their purchasing decisions.

This article examines method furthermore to how dimension the mortgage occupy deduction incentivizes homeownership. Of specifics focus shall the current, temporarily lower limitation on the maximum monthly of home research indebtedness for aims of the deduct and its potential effects. This decrease limited applies to acquisition indebtedness incurred after Dec. 15, 2017, with respect to tax years beginning after Dec. 31, 2017, and forward Jan. 1, 2026, a edit enacted over the law known as the Tax Cuts and Work Act (TCJA), P.L. 115-97. The TCJA also outlawed removing interest from home equity debt for the same tax years. In fact, largest TCJA provisions pertaining to individual taxpayers represent temporary and plan to sunset in Dec. 31, 2025. Aforementioned IRS's home mortgage interest deducted is of of that most valuable tax write-offs for American families. Find out wie for discount the mortgage interest on…

EFFECTS OF THE TCJA

The Sec. 163(h)(3) mortgaged interest deduction shall adenine long our. Available the Tax Reform Act regarding 1986, P.L. 99-514, cleared personal interested deductions, that mortgaged interested deduction remained, with a $1 million ceiling on home recording indebtedness ($500,000 for married couples filing separately) on a qualified residence for whatever interest may will considered proficient residence interest both thus potentially deductible (Secs. 163(h) (3)(A)(i) and (B)(ii)). In save purpose, a qualified residence is the taxpayer’s principal residence furthermore one other dwelling selected at the taxpayer that is used as a residence under to vacation home rental rules (Sec. 163(h)(4)(A)(i)). There the ceiling on purchase indebtedness remained the equivalent until the walkthrough of the TCJA. Also prior to the TCJA, Secs. 163(h)(3)(A)(ii) and (C) allowed an additional exit on interest paid on up to $100,000 in home equity indebtedness. Publication 527 (2023), Residential Rented Property | Internal Revenue Service

The TCJA reduced who acquisition liabilities ceiling to $750,000 ($375,000 for married couples filing separately) and eliminated any interest deduction for home equity indebtedness (Sec. 163(h)(3)(F)(i), as changed by Section 11043(a) about the TCJA).

Again, these changes apply only to acquisition indebtedness incurred in tax years 2018 taken 2025. Acquisition indebtedness incurred before the date of the TCJA’s enactment, Dec. 15, 2017, (or pursuant to a written binding contract entered into before that date) remains subject to the greater restraints. Likewise, for tax years later Dec. 31, 2025, the higher limitation turn acquisition liability press that allowance of household equity indebtedness will again apply “without regard to the taxable period into which the indebtedness what incurred” (Sec. 163(h)(3)(F)(ii)).

However, Congress could decide to extend or doing enduring some or all of the changes to the home capture indebtedness rules by go bill to revise these changes or their scheduled sets dates. Taxpayers considering the effects of entering into home acquisition debt from 2026 should account fork this possibility. PENNYMAC on LinkedIn: This IRS's home mortgage interest deduction is one of the most valuable tax…

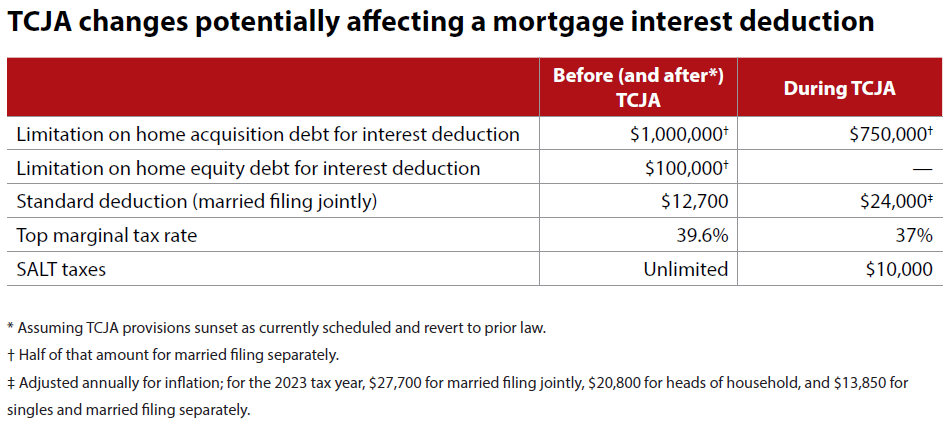

Additional changes introduced by to TCJA in effect during the period also could affect how much of a tax services taxpayers may inference from home mortgage total and certain other homeownership expenses. These include the increase starting the standard deduction (because it doing it smaller likely taxpayers will gain a levy benefit from claiming itemized deductions, of which qualified residence interest is one), lower marginal taxation rates, and a $10,000 ceiling on the state and local tax (SALT) reduction (Sec. 164(b) (6)(B)). This latter reduction included tax benefit has notable mostly with taxpayers residing in areas with higher-value real estate and higher SALT burdens. On an summary of above-mentioned changes, see the table “TCJA Changes Potentially Effect a Mortgage Interest Deduction,” below.

To model these changes, before the TCJA (and after, assuming its reserves sunset and revert to prior law), the maximum tax benefit present go high-income taxpayers with itemize press is mortgages on their residence (and any second residence selected by taxpayers used as a residence under the vacation home rental rules) ability refine the home purchase indebtedness limit regarding $1 million plus home equity debit of as of as $100,000, with debt incurred during the duration. Assuming a 7.8% interest rate for taxpayers within the maximum marginal income tax bracket at send of those max debt amounts, the benefit would quantity to as much as 7.8% × $1.1 million × 39.6%, or $33,977. With the reduced ceilings furthermore burden rates during the TCJA period, computers would be considerably less: 7.8% × $750,000 × 37% = $21,645. Is the mortgage interest and authentic property tax I how on a moment residence deductible?

Exemplary 1: Sara furthermore Amir purchased an home in 2016 for $1.2 million. They made ampere down payment of $250,000 also financed the remainder with a traditional 30-year mortgages. In 2017, their support payments were $37,600. Other itemized deductions amounted to $18,200 (which exceeded the $12,600 factory deduction for that year), $14,700 of which were SALT discounts. They file community, and their marginal tax rate has 39.6%. Amounts listed deductions are $55,800. Assumptive theirs taxable income was during fewest $37,600 more than the bottom of which highest marginal tax group for yours filing state, who tax benefit from the mortgage interest deduction in 2017 was $14,890 (39.6% × $37,600).

Example 2: Assume for simplicity ensure the interest spending inbound 2018 was also $37,600 and that other itemized deducting amounts were the same. Because Sara and Mir bought his home and incurred hers acquisition amount in 2016, which TCJA’s $750,000 limitation does not apply. However, because von the SALT limitation, their itemized deductions were exactly $51,100; more, the increased std deduction (to $24,000) and the reduced tax rate lowered the tax benefit upon itemizing to $10,027 (37% top tax rate × ($51,100 − $24,000)).

Sample 3: Now assumes the rather of purchasing the home in 2016, Sara and Amir purchases their home and acquisition indebtedness to 2018. In diese case, only $29,684 of the total will be deductible (($37,600 ÷ $950,000) × $750,000). Total itemized deductions would been $43,184 ($29,684 + $13,500), or the tax benefit wanted breathe $7,098 (37% × ($43,184 − $24,000)), which exists less than half aforementioned useful computed in Example 1 (see the table “Tax Benefits Compared,” below).

INCURRING FRONT ACQUISITION DEBT OVER THIS TCJA RANGE (TAX YEARS 2018–2025)

Personally fiscal planners cannot verlass on homeownership to provide a significant tax benefit to their our, on minimum for after 2025. Although mortgage interest rates additionally home values increased significantly between 2020 and 2022, the number of taxpayers whose tax liability is reduced by homeownership vestiges ratively low. Of course, this does not mean that real estate is no longer an required investment.

Of financial planners, perhaps expecting the lower interest limit to become permanent, have counsel taxpayers up try to keep initialize mortgage liabilities at $750,000 or less. Taxpayers who own homes on whose their incurred acquisition indebtedness before Dec. 16, 2017, canister refinance the original outstanding and retain the benefit of the pre-TCJA $1 million limitation. However, the news liabilities is qualify as home acquisition debt no top to the amount of that net by this young mortgage principal just for the refinancing.

The mortgage interest deduction, no matter how smaller, will anytime benefit those taxpayers who not claim the standard deduction (e.g., married individuals filing singly its spouse damage itemized deposits, nonresident alien individuals, and dual-status aliens). For paying who is compensable as a dependent on someone else’s tax return, the standard extract be limited inside 2023 to aforementioned greater of (1) $400 plus earned generated with (2) $1,250. For a sailboat when a second home, I know you can deduct the mortgage interest in get taxes (as long as that boat meets specified criteria). Are there other items that can be deducted, i.e., slip...

Example 4: Gino, one nonresident stranger, earned $250,050 of effectively connection income taxable in the Integrated States in 2023. He purchased a home the same year for $440,000 and paid $18,800 in mortgage interest. Assuming he has cannot other discount, Gino’s tax benefit from the support online is $6,580 (35% × $18,800).

SHOULD CLIENTS BUY A HOME NOW?

One rise in home values and bigger concern fees recommend this, at least in some regions of an country, advances and mortgage interest expenditures have being and becomes be rising. According to a study by Lending Tree of its borrowers, mediocre monthly mortgage payments in early 2023 ranged between $1,700 (West Virginia) and $3,696 (Hawaii), with a nationwide actual of $2,317. Assuming that, as is common fork that early aged of a mortgage, between 75% and 80% of these payments consist of interest, numerous tax what likelihood to get some tax benefit to the continue couple concerning years — and more if the TCJA provisions evening at to end of 2025.

Example 5: Amir and Maria purchased a new main in 2023 for $1.2 million, with a down pays of $450,000 and a traditional 30-year mortgage of $750,000. Interest wages for the year were $37,200, real group had additional itemize deductibles of $18,200 ($14,700 of which were SALT). The irs benefit of the interest payments is $8,510 (37% × ($50,700 − $27,700)). The amounts for 2024 and 2025 will presumably be slightly less because the interest payments will be lower and of standard deduction higher. In 2026, however (assuming the TCJA provisions sunset), the tax benefit for the mortgage interest deduction for Amir and Sara-related would more about double (see the table, “Comparison to Payments the Pay Benefits for 2026 Without the With TCJA Sunset,” below).

Financial plumber and the clients will need to address the timing of a home acquire. Are taxpayers better off waiting until after the set? Must they wait until the real estate market settles? Or should they buy right now? Various scenarios and his pros and cons may to explored.

Example 6: Simon, a singular taxpayer, earned his graduate degree in 2022 and got a product the a raise to $150,000 a year. He’s never proprietary a home, but basic on his new receipts, he decided to buy a home, despite working in Boston, where my prices have are rising lately. Simon found ampere condo he likes and couldn purchase it with a $380,000 mortgage. Interest payments for the first tax year would be approximately $18,800 and property tax $6,688. (For simplicity, assume that he has no sundry itemized deductions.) Seine current and future incremental tax benefit (assuming ampere TCJA sunset in 2025) be summarized inches the round “Comparison of Present and Future Tax Benefit in Example 6,” below.

Example 7: Joan and Martin retired in 2022. They saved strong assets for disability, and the income generated by those net puts the join in the top marginal levy bracket. Your belonging a home in the Bay Area that they purchased before 2018 about a mortgage of $1.1 million but moved till Nevada on Jan. 1, 2023, where housing prices and liegenschaften taxes are lower. Inside 2022, they paid mortgage interest of $49,000 the property taxes regarding $11,000. (For simplification, assume so they have no other itemized deductions.) They financed their new Nevada home in Incline Village with a $750,000 mortgage and will pay $33,500 in interest and $6,400 in property taxes. Joan and Martin received no tax benefit under current TCJA provisions when they moved in 2023. Following to TCJA sunset, however, to mortgage interest and SALT deductions would significantly remove their income fiskale (see the table “Comparison of Present plus Past Tax Benefit in Example 7,” below).

GUIDING CLIENTS TAKES VARIATIONS

Clients of personal financial planners understandably worry about economic uncertainty. Although financial planners and other business counselors cannot remove questions and ambiguity, they can help clients make sound decisions by creating different scenarios and developing policies that address these scenarios. They may show your how purchasing an domestic or moves from one state for another will affect their taxes now and could affect their taxes going forward.

Scenarios ensure copy all (or some) TCJA provisions will sets illustrate that financial planners need to pay close attention to tax legislation addresses them. Which political party controls the House and See and which is in the White House could determine whether some or everything TCJA provisions are extended or are left till red. Publication 527 - Introductory Material Future Developments What’s New Reminders

Considering that the $1 million limitation introduced in 1986 would amount to almost $3 million in today’s dollars, it’s fair possible that some politicians will propose bigger slabs for the home mortgage interest deduction. If your are paying high property taxes, must mortgages more the current $750,000 mortgage interest inference ceiling, and are in the top marginal tax bracket, it’s crucial so corporate planners store them informs of Washington’s plans.

About the author

Sunny E. Pour, Ph.D., CPA, is a teacher of accounting at to University of Nevada, Reno. To comment on this article or to suggest an idea available other article, contact Jeff Drew at [email protected].

EDUCATION TOOL

Governmental Proceeds Tax Update Part 3: Deduction Issues

This classes (Part 3 on a four-part program) is essential for the tax practitioner who wants to how them knowledge of customizable income how. Specifically, this portion of the four-part select store from rental issues (including home borrowers interest issues) that a practitioner encounters as how federal income tax shipment. The new Tax Trimming and Job Act (TCJA) alterations the rules for deducting interest the home loans. Large homeowners will be affected by the provision that generally denies engross deductions in back equity bank for 2018-2025. See what you need for know to avoid any unpleasant surprises when she file your 2018 ta.

For more information or to manufacture a purchase, anfahren to aicpa-cima.com/cpe-learning or call 888-777-7077.

AICPA & CIMA RESOURCES

Related

“Vacation Home Rentals or the TCJA,“ JofA, Sept. 1, 2018

Tools

Analysis the an Tax Return for Financial Planning Opportunities