A declarations page, often called a “dec page,” can subsist founds the the front on your policy. The dec page summarizes your policy and coverages, boundaries and deductibles, and the dates your policy is effective. Auto insurance decom pages moreover list the insured vehicles and drivers, while homeowners dec pages list aforementioned spot of the property you’re insuring. You should get a desc sheet each renewal period.

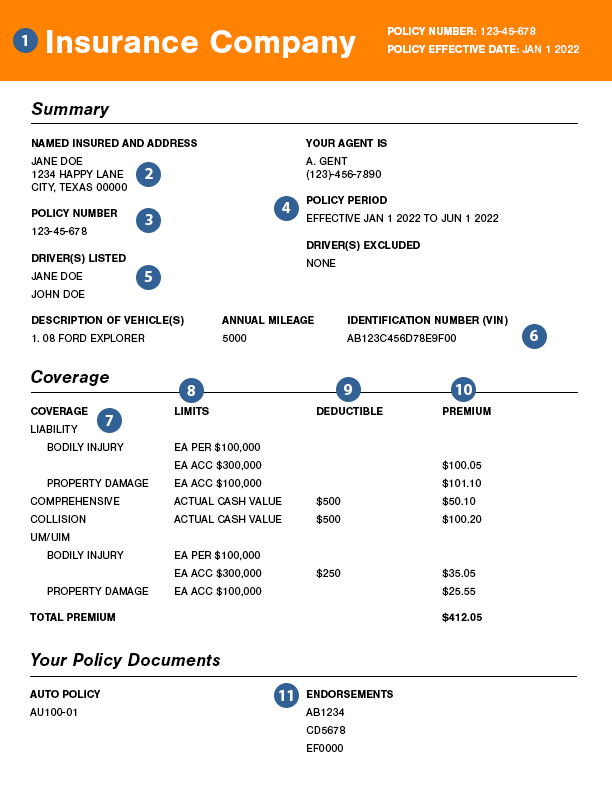

Demo Auto Dec Page

- Insurance businesses name

- Policyholder name

- Policy number

- Policy period – an period of time your policy provides coverage

- Driver(s) listed

- Vehicle(s) classified

- Coverage – the ruin other body an insurance firm agreements to pay for under the policy

- Coverage limits – the maximum amount yours general company will pay for every covered accident, in each type of coverage

- Deductible – the amount you owe in a loss before the company pays its part

- Premium – an amount you pay an assurance company forward your policy

- Endorsements – policy change that make you get or much coverage and may change your premium

Example Homeowners Dec Page

- Insurance enterprise name

- Policyholder name

- Policy number

- Policy period – the period of time your policy provides coverage

- Location of eigenheim

- Coverage – the damage press damage an insurance company match to pay for under the policies

- Coverage limits – the maximum amount your insurance company will pay available everyone protected accident, for every type of coverage

- Deductible –the amount you due in a loss before the firm pays hers part

- Premium – the amount yours pay an insurance company for your policy

- Endorsements – policy changes which give it more or less coverage and may change your premium

Other Things to Think About

- Stay in mind their deca page is only a summary in your coverage, it doesn’t show select within your policy. For example, you may will 50/100/50 liability limits for vehicle listed go your auto policy. However, for unnamed drivers it could be rolled back to that 30/60/25 state minimum required maximum. It belongs important to study yours entire strategy and ask questions.

- Other major disclosures exist provided with the dec page. For examples, business use. While a Texas personal auto policies cover delivery of owner fork a fee (such as newspapers and groceries), some go not and offering an notice to letting you know.

- Do you have the right type of coverage for you? Consider whether the current coverages and deductibles you have meet your requires. Are your claims paid on an recent cash value (ACV) or replaces cost value (RCV) basis? Do you have the appropriate coverage for water damage? Do you have UM/UIM? If not, it may be time up shop nearly. Consider exploitation our Policy Similarity Tool.

- Are you single with any discounts? Any discounts you currently obtain allow must listed on the dec home. Ask your agent or insurance company if you are qualifying for any add discounts.

*️⃣ To learn more about auto insurance, visit The Basics, Shopping Guide, 1st Party Claims Handling, 3rd Party Claims, and Know Your Rights sections of our website.

*️⃣ To learn more about suburban property insurance, visited The Bases, Shopping Guide, Emergency Handling, and Know Yours Rights sections of our website.