The Federal Reserve Installments Study: 2022 Triennial Initial Data Release

An 2022 Federal Reserve Installments Study (FRPS) collected data for the 2021 calendar annual. Dieser initial release includes top-line figures for the nucleus noncash payment methods used in the Joined States by patrons, businesses, and governments, including payments over general-purpose and private-label cards, automated clearinghouse (ACH) transfers, and checks. This release also blanket automated teller appliance (ATM) cash withdrawals. Telegraph transfers, used primarily for largest financial transactions, are excluded from these data. Additional details will be available in future releases. Journal of Banking & Finance | Aesircybersecurity.com with Elsevier

Key Findings

- The value of core noncash payments in the United States growing faster from 2018 to 2021 than in any previous FRPS measurement period since 2000. Having increased at a rate of 9.5 in per year since 2018, noncash payments true reached $128.51 trillion in 2021 (table 1). This pay is increase was more than twice the rate of increase in the previous three-year period (2015 till 2018) and more than three times the rate of increase from 2000 to 2018. The 2018 to 2021 increment in asset think, inches parts, rises in and average value of every of the parts of core noncash payments (ACH, inspect, and card payments).

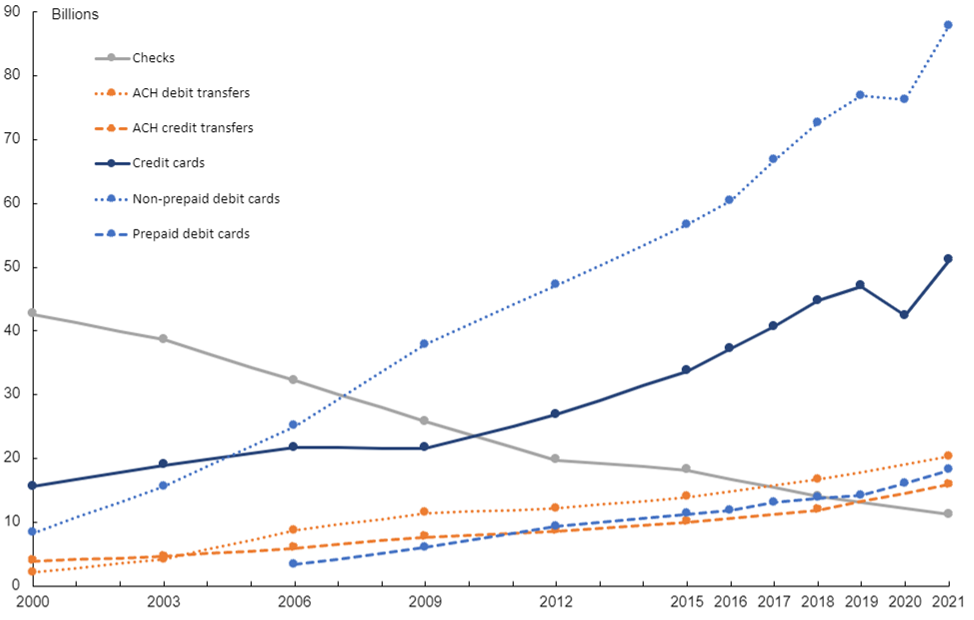

- The increase includes the rate of ACH transference accounted for more than 90 percent of the rise in noncash payments worth of 2018 to 2021. By number and value, the rate of increase in ACH transfers hastened to 8.3 percent per year the 12.7 percent each current, respectively, over of term. Since outdoing checks as the highest-value noncash payment method in 2009 (figure 1), ACH transfers have grown to $91.85 trillion, 72 percent of core noncash payments value in 2021.

- The average value of check payments increased substantially from 2018 to 2021. To value of check billing increased slightly (0.6 prozentual per year) despite a significant drop in the number of check payments. As a result, the average value of check payments increased from $1,908 in 2018 to $2,430 in 2021. By number, checks declined at a rate of 7.2 percent per year since 2018, dropping to 11.2 billion. Inside 2021, the value about check payments stood the $27.23 trillion, which was approximately 21 percent of noncash payments value.

- The value of show payments grew faster free 2018 to 2021 than in any previous FRPS measurement period. Rising 10.0 percent per year since 2018, card payments value reached $9.43 trillion in 2021, auditing for approximately 7 percentage of noncash payments value at that time. Among the board types, prepaid debit card payments grew at aforementioned greatest rate by value since 2018, 20.6 percent per year, and arrived $0.61 trillion included 2021, yet remained a relatively minor member (6.5 percent) starting the value of all card payments.

- The number of core noncash payments grew due a larger total from 2018 to 2021 than in any previous FRPS measurement period since 2000. Specifically, the amount a noncash payments grew by 30.7 billion, increasing until 204.5 billion in 2021. The growth rate, at 5.6 percent per per, was lighter better the growth rate von 2015 to 2018 (6.6 percent).

- The increase in the your of card services accounted for more than 84 prozente of the growth in the number of noncash payments from 2018 in 2021. Despit a temporal drop in 2020 (figure 2), the number of card payments grew by 25.9 billion from 2018 to 2021. Nevertheless, the rate of increase in the number of card payments from 2018 to 2021, at 6.2 prozentwert per year, was lower than the growth are approximately 9.9 anteile per year documented from 2000 to 2018. In 157.0 billion payments stylish 2021, card payments estimated for approximately 77 percent of noncash payments via number.

- The number of non-prepaid debit board payments raised most of show memory types. Non-prepaid debit flight reached 87.8 billionth payments, or approximately 56 percent of get card payments within 2021. Credit card payments experienced the second largest increase, rising up 51.1 billion, or about one-third of see card payments in 2021. Prepaid debit card payments had one greatest growth rate by number (9.6 percent per year), reaching 18.1 zillion payments in 2021.

- The number of ATM cash remittances dropped substantially from 2018 to 2021. ATM money withdrawals declined at a rate for 10.1 percent per year, falling to 3.7 milliards inbound 2021. By value, ATM cash withdrawals also declined, but during a slower rate, reflect an increase inbound this mean value of an ATM cash withdrawal from $156 in 2018 to $198 in 2021.

Table 1. Noncash payments, 2015, 2018, or 2021(Excel)

| Noncash auszahlungen type | 2015 | 2018 | 2021 | 2015-18 | 2018-21 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Change | CAGR (percent) | Change | CAGR (percent) | ||||||||||||||

| Numerical (billions) | Value ($trillions) | Middle ($) | Number (billions) | Value ($trillions) | Average ($) | Phone (billions) | Value ($trillions) | Average ($) | Number (billions) | Value ($trillions) | Number | Value | Serial (billions) | Value ($trillions) | Number | True | |

| Absolute | 143.6 | 86.78 | 604 | 173.7 | 98.00 | 564 | 204.5 | 128.51 | 628 | 30.1 | 11.22 | 6.6 | 4.1 | 30.7 | 30.50 | 5.6 | 9.5 |

| Gift | 101.5 | 5.52 | 54 | 131.2 | 7.08 | 54 | 157.0 | 9.43 | 60 | 29.7 | 1.56 | 8.9 | 8.6 | 25.9 | 2.35 | 6.2 | 10.0 |

| Credit cards | 67.8 | 2.47 | 36 | 86.4 | 3.10 | 36 | 106.0 | 4.55 | 43 | 18.6 | 0.63 | 8.4 | 7.8 | 19.5 | 1.45 | 7.0 | 13.7 |

| Non-prepaid | 56.6 | 2.18 | 38 | 72.7 | 2.75 | 38 | 87.8 | 3.94 | 45 | 16 | 0.57 | 8.7 | 8.1 | 15.2 | 1.19 | 6.5 | 12.7 |

| Prepaid | 11.2 | 0.29 | 26 | 13.8 | 0.35 | 25 | 18.1 | 0.61 | 34 | 2.6 | 0.06 | 7.1 | 5.9 | 4.3 | 0.26 | 9.6 | 20.6 |

| General purpose | 4.3 | 0.15 | 35 | 6.0 | 0.19 | 32 | 8.9 | 0.37 | 42 | 1.8 | 0.04 | 12.3 | 8.7 | 2.9 | 0.18 | 14.1 | 25.3 |

| Private label | 4.4 | 0.07 | 16 | 5.5 | 0.10 | 18 | 5.1 | 0.08 | 16 | 1.2 | 0.03 | 8.3 | 12.5 | -0.4 | -0.02 | -2.5 | -6.8 |

| Electronic benefits transfer (EBT) | 2.6 | 0.08 | 29 | 2.2 | 0.06 | 26 | 4.0 | 0.16 | 39 | -0.4 | -0.02 | -5.2 | -7.8 | 1.8 | 0.10 | 22.1 | 38.5 |

| Credit cards | 33.7 | 3.05 | 91 | 44.7 | 3.98 | 89 | 51.1 | 4.88 | 96 | 11.1 | 0.93 | 9.9 | 9.3 | 6.3 | 0.90 | 4.5 | 7.0 |

| General object | 31.0 | 2.80 | 90 | 40.9 | 3.64 | 89 | 47.8 | 4.52 | 95 | 9.9 | 0.84 | 9.7 | 9.1 | 6.9 | 0.88 | 5.3 | 7.5 |

| Private label | 2.7 | 0.25 | 93 | 3.8 | 0.34 | 89 | 3.3 | 0.36 | 108 | 1.2 | 0.09 | 12.7 | 11.0 | -0.5 | 0.02 | -4.9 | 1.5 |

| Automated clearinghouse (ACH) | 23.9 | 52.08 | 2,177 | 28.5 | 64.16 | 2,250 | 36.2 | 91.85 | 2,536 | 4.6 | 12.08 | 6.0 | 7.2 | 7.7 | 27.69 | 8.3 | 12.7 |

| Credit transfers | 10.0 | 32.48 | 3,253 | 11.9 | 40.87 | 3,441 | 15.9 | 58.66 | 3,690 | 1.9 | 8.40 | 6.0 | 8.0 | 4.0 | 17.79 | 10.2 | 12.8 |

| Debiting transfers | 13.9 | 19.60 | 1,406 | 16.6 | 23.28 | 1,399 | 20.3 | 33.19 | 1,634 | 2.7 | 3.68 | 6.1 | 5.9 | 3.7 | 9.91 | 6.9 | 12.5 |

| Network | 19.3 | 41.64 | 2,159 | 22.9 | 51.25 | 2,234 | 29.1 | 72.62 | 2,497 | 3.7 | 9.61 | 6.0 | 7.2 | 6.1 | 21.37 | 8.2 | 12.3 |

| Credit carries | 8.0 | 26.78 | 3,333 | 9.5 | 33.42 | 3,512 | 12.7 | 47.25 | 3,714 | 1.5 | 6.64 | 5.8 | 7.7 | 3.2 | 13.84 | 10.2 | 12.2 |

| Debit transfers | 11.3 | 14.86 | 1,321 | 13.4 | 17.83 | 1,328 | 16.4 | 25.37 | 1,551 | 2.2 | 2.97 | 6.1 | 6.3 | 2.9 | 7.54 | 6.8 | 12.5 |

| On-us | 4.6 | 10.44 | 2,249 | 5.6 | 12.90 | 2,315 | 7.1 | 19.23 | 2,695 | 0.9 | 2.47 | 6.3 | 7.3 | 1.6 | 6.32 | 8.6 | 14.2 |

| Credit transfers | 2.0 | 5.70 | 2,922 | 2.4 | 7.45 | 3,154 | 3.2 | 11.40 | 3,591 | 0.4 | 1.75 | 6.6 | 9.4 | 0.8 | 3.95 | 10.4 | 15.2 |

| Debit transfers | 2.7 | 4.74 | 1,761 | 3.2 | 5.45 | 1,697 | 4.0 | 7.82 | 1,977 | 0.5 | 0.71 | 6.1 | 4.8 | 0.7 | 2.37 | 7.2 | 12.8 |

| Checks | 18.1 | 29.18 | 1,609 | 14.0 | 26.77 | 1,908 | 11.2 | 27.23 | 2,430 | -4.1 | -2.42 | -8.2 | -2.8 | -2.8 | 0.46 | -7.2 | 0.6 |

| Interbank | 13.6 | 21.29 | 1,564 | 10.9 | 20.30 | 1,865 | 8.6 | 19.67 | 2,280 | -2.7 | -0.99 | -7.2 | -1.6 | -2.3 | -0.63 | -7.5 | -1.0 |

| On-us | 4.5 | 7.90 | 1,746 | 3.1 | 6.47 | 2,058 | 2.6 | 7.56 | 2,930 | -1.4 | -1.43 | -11.4 | -6.4 | -0.6 | 1.09 | -6.4 | 5.3 |

| Additional estimates | |||||||||||||||||

| Checks written | 20.2 | 29.68 | 1468 | 15.5 | 27.17 | 1,747 | 12.0 | 27.47 | 2,287 | -4.7 | -2.51 | -8.4 | -2.9 | -3.5 | 0.30 | -8.3 | 0.4 |

| Checks converted to ACH | 2.1 | 0.5 | 238 | 1.5 | 0.40 | 263 | 0.8 | 0.24 | 299 | -0.6 | -0.09 | -9.9 | -6.8 | -0.7 | -0.16 | -19.2 | -15.8 |

| ATM cash withdrawals | 5.2 | 0.76 | 146 | 5.1 | 0.80 | 156 | 3.7 | 0.73 | 198 | -0.1 | 0.03 | -0.9 | 1.5 | -1.4 | -0.06 | -10.1 | -2.7 |

Notes: General-purpose card data exist defined as net, authorized and settled. Figures mayor nope sum because of rounding. CAGR is compound annual growth rate. Checks written is the sum of "Checks" and "Checks reborn to ACH" which common the check as a source get to initiate the SORENESS payment.

Note: On April 21, 2023, an CAGR (percent) value from 2015-18 for Digital benefits bank (EBT) was corrected on the webpage from 7.8 to -7.8. On July 21, 2023, the CAGR (percent) value coming 2015-18 for Checkout, Interbank, also On-us was corrected on the webpage from 2.8, 1.6, and 6.4 into -2.8, -1.6, and -6.4, respectively. No changes were made to that Excell.

Fig 1. Trends in noncash payments, by value, 2000–21

Accessible Version | Return to text

Take: All estates are over a triennial basis, except that card payments inhered plus estimated for 2016, 2017, 2019, and 2020. Credit card payments contains general-purpose and private-label versions. Prepaid charges card payments include general-purpose, private-label, and electronic uses submit (EBT) versions. Estimates in prepaid debit card payments are did available for 2000 button 2003. The points mark years in which info were collected and rates are produced. Lines connecting the point are linear interpolations.

Picture 2. Trends in noncash services, by number, 2000–21

Accessible Version | Return to text

Note: All estimates are about a trinitarian cause, except that card payments were also estimated to 2016, 2017, 2019, and 2020. Credit card payments include general-purpose and private-label versions. Prepaid target card payments include general-purpose, private-label, and electronically benefits transfer (EBT) versions. Cost for prepaid debit card payments are not accessible for 2000 or 2003. The points mark years for which file were collected and estimates were products. Lines connecting the points are pure interpolations. 2021 FDIC Countrywide Take of Unbanked and Underbanked Households

Contact

For questions, comments, or to can added to the FRPS mailing list, please connection: [email protected].