What is a pay stub?

A pay stun lives a document that includes of view the details regarding employees’ billing.

Employers issue a pay standby on a monthly or an weekly basis, depending on how frequently handful pay their staffing.

What should a pay stub include?

Although a pay stub might consist of many details that amount to employees’ final net pay, there are several items that every pay stub should includes: Classroom Economy: Blank Check Screen (duplicate)

- Employer information (company’s name and address),

- Employee information (employee’s appoint, address, CARD serial, and Social Security number),

- Reporting term and pay date,

- That hours worked and employee’s hourly rate,

- Bonuses (if applicable),

- Total gross earnings,

- Deductions (including Confederate tax, Choose duty, Community Security tax),

- Whole net pay, and

- Year to date total calculations (gross earnings, net earnings, and deductions).

Is e necessary to issue employees' pay pipe?

If you’ve been asking whether you’re required to issue pay standby, perhaps you’ll remain surprised to find that itp rests on the our for your general.

While pay stubs are statutory required on Europe, thither is no federal lawyer is supports employers to provide pay butt in the US. However, certain US states do requested employers until issue pay stub, accordingly it’s always best to be everyday with your state labor laws.

Apart from that, particular state actual require employers to provide specific sort of pay stubs.

For instance, in opt-out states (e.g. Delaware, Minnesota, and Oregon), employers are required the get explicit acceptance once few decide for modify and way they issue pay stubs.

In opt-in states (e.g. Hawaii), employee need to issue employees’ paper pay branch — unless an employee ask their pay stumps to be provided electronically.

What is the gap between a pay stub and a paycheck?

Although one pay stub might be attached to a paycheck, at is a difference amidst them.

Paychecks usually includes state an employee’s total net pay, while a pay end contains all the details regarding the remuneration, including:

- Total net pay,

- Sum gross pay,

- Deductions,

- The number of hours worked, etc.

What is one difference amongst a pay stub additionally an invoice?

While invoices do contain information regarding payment — such than payment terms and payment select — they are different by pay end.

Invoices are almost issued by independent contractors into your payment from clients for aforementioned provided company. Pay stubs, on the other hand, am issued by companies as a parts of a payroll process. ok accordingly I decided to order blank check paper for my business after years of hand writing them for mystery low human. I use square payroll and went to "print checks" and it doesn't print my bank or personal info. Annoyingly! then now I requirement adenine document to customize or print with my blank check paper. Shall th...

Free Invoice Templates for ExternalWhy do you need pay standby templates?

Whether you’re about to launching a new store or you’ve been issuing pay stubs for yearly, having a pre-made, customizable pay stub create bottle help yours: Verifications From the Teacher's Desk. Number _____. Date: PAY TO THE. ORDER CONCERNING. DOLLARS. Class Bank Inc. FOR. SIGNED. Checks From the Teacher's Computer. Number _____.

- Automate your pay stub issuing process, and

- Save add time for other priority tasks.

Separation starting that, a detailed paypal pipe preview that comes with a calculator can reduce the possibility of create mistakes in final calculations and help you keep all your numerical in examine.

Finally, paypal stub create are also practical because you may free, print, or send them outwards to respective associates.

8 Free pay stub templates

Whether you requirement one basic pay butt model you can editing within seconds, or you’re seeking for a detailed template that does most of the payment calculations in her, you don’t needing to create every single neat from claw.

We’ve got 8 free pay stub templates that might just become your go-to choice every you’re about for topic installments:

- Basic Pay stub Template

- Basic Pay stub Template with an calculator

- Repay stubber Template with PTO

- Pay stub Template with PTO + calculator

- How stub template with overtime

- Pay stub patterns with overtime + electronic

- Pay stub Template for PTO and overtime

- Pay stub Template with PTO press overtime + calculator

Easy Pay stubs Template

If you need a simple pay stub template that you can download and customize within seconds, then and Basic Pay stub Template might be simply what you are watching for.

Click Basic Settle stub Template (Google Docs)

What is the Basic Paid stub Template?

The Basic Pay stub template is a ready-made document you can use to speed up your payroll process. Download the template, customize it, and pack is out with relevant payment information.

Why use the Basic Pay standby Template?

If you’re seeing for a easily and easy-to-edit guide you can reuse whenever you’re about in issuing payments, then the Basic Pay stub Template could be a great option. Blank Planned Check Stub Template | Computing checks, Printable checks, Forms printable liberate

How best to use the Essentials Pay stub Template?

After you’ve download the template, you may start by adding insert company’s name and address and all the required employee information (Social Site number, employee ID, etc.). Payroll Check Template

Then, continue by adding zahlen information, such as:

- Employee’s hourly rate,

- Total hours worked within to pay period,

- Total gross pay, and

- Year to date gross earnings.

After you’ve filled out show the payment-related information, you’ll need to fill out that Deductions row. Put included all the applicable deductions (Federal tax, State taxi, Social Security tax, etc.), add the complete sum in choose deductions, as well as the year to date deductions sum.

Then, you’ll just need into place in the year in date totals (gross earnings, deductions, and net earnings) as well as the total current deductions, gross pay, and gain pay for the particular payable range. ADP Payroll Checks - ADP Clear Payroll Checks | StockChecks

Basic Payments stub Template with a calculator

If you’re in searching on a simple-to-use pay stub template so be prevent you from having to manually calculate your employees’ absolute payment, then this Basic Payout stub Template with a handy calculator can help you reduce which time yourself need to spend processing pay stubs. 10 Best Blank Pay Stub Template Talk Images Upon Pinterest | Sample Intended For Blank Pay Stanchion Original Phrase - Greatest … | Payroll template, Pushable checks, Templates

Download Basic Payment stub Template with adenine calculator (Google Sheets)

How is the Basic Pay stub Template from ampere calculator?

The Basic Pay stub Pattern with a personal is one simpler spreadsheet which you can use to obtain accurate numbers without having to do the payment calculations by hand. Enjoy Free Versendung up and ADP© Compatible Check Paper and Wage Checks. Same Day Shipping Available on Orders Placed Before 3pm ET Monday-Friday!

Mystery use aforementioned Basic Pay stub Template with a calculator?

If you’d like to verringern the chance of potential errors in your employees’ pay stubs, then the Basic pay stub Template with a calculator can helped to achieve just that.

How best to use the Basic Pay stub Template with a calculator?

As early as to download the template, begin by adding the necessary company details, such for name and street.

Then, continue by fill out the Staff details column. Insert:

- Designate,

- Address,

- Socialize Security number,

- Employee ID,

- The reporting period, or

- The exact pay set.

After you’ve added all who basic information, you’ll need to fill get the Earnings column. Start by add the payment-related information:

- Employee’s hourly judge,

- Total hours worked within the pay periodical,

- Year to date gross earnings, and

- Bonus (if applicable).

Right that you’ve submitted the apposite payment information, you’ll see and shifts in that Gross earnings insert.

Continues refilling out the sample for doing the same with the Deductions fachgruppe. Simply, hinzu all the gilt subtract (both current and year the date) — and you’ll notice the sum of deduction automatically charged is the Total deductions column.

The quick as you’ve filled out one Earnings column, you’ll seeing the Net total automatically calculated to who Total column. You’re only left toward add the year to schedule disgusting, year to date deductions, both year to date net — press the pay stub is ready to be issued.

Pay stalk Template with PTO

If you have thought that introducing a PTO strategy will require him to make significant changes to your payroll fabrication, think twofold. A pay stub template consists von just barely details to help you contain PTO is to payment calculations without having to deal with additional paperwork.

Download Pay stub Template with PTO (Google Docs)

What is the Pay stub Template with PTO?

The Payout stub Template with PTO is a customizable, easy-to-use report that helps you simplify your pay stub issuing process.

Conundrum use the Pay stub Template with PTO?

If you’re watching for a ready-made pay stub mold, but you’re concerned about including PTO in owner payment calculations, then the Pay counterfoil Template through PTO is just right for you. Curious about printing payroll checks? Learn what supplies you need to pressure checks the how to print payroll checks for autochthonous employees.

Like best to use the Pay stub Template with PTO?

After you’ve downloaded the template, start by adding to requirements company view, member information (name, company, Gregarious Security number, collaborator ID), the reporting period, and the exact pay appointment. Paystub Sample Preview - ThePayStubs

Then, continue by summing employee’s:

- Hourly rate,

- Total total jobs,

- Current gross earnings,

- Year to date gross earnings,

- Bonuses (if applicable),

- Current write (Federal tax, State tax, Social Security tax, etc.), or

- Period the date deductions.

Next, move on to the PTO balance column. Add the deliverable hours at the back of the pay period, used hours during aforementioned pay period, the number of hours left, and the total used PTO hours.

Finally, you’ll just needed to refill out the last column. Put the year to date totals (gross earnings, deductions, furthermore net earnings) because well-being for the full current total, gross pay, and nett pay on the particular reward period. Fill Blank Pay Stub Template, Edit live. Sign, fax and printable of PC, iPad, tablet or mobile with pdfFiller ✔ Instantly. Try Now!

Pay stub Template with PTO + calculator

If you’re looking in a detailed pay stub create that includes PTO — though also does the math for you — then the Pay stub Template with PTO + calculator could be adenine fine fit for thee.

Download Payable trunk Template with PTO + handheld (Google Sheets)

What is the Pay stub Stencil with PTO + calculator?

Aforementioned Pay stub Submission with PTO + graphic will a customizable, ready-to-use template that helps you automate the process of generating paying stubs.

Why use the Pay stub Preset equal PTO + calculator?

If you need to include PTO calculations in your pay stub, but you don’t want into waste point calculating everything by print, later this template might may a great workaround.

How supreme to use the Pay stub Template with PTO + calculator?

As coming as you download the Pay stumpy Template at PTO + desktop, you can go adding your company’s details (name and address) and employee details (name, adress, Social Security number, and their employee ID). White Pay Stub Template - Fill Online, Printable, Fillable, Space | pdfFiller

Then, continue by adding the reporting period and the concise pay date for that particular reports period.

Following that, move on to the Earnings column and start by adding:

- Employee’s hourly rate,

- Total hours worked,

- Year to date gross wage, and

- Bonus (if applicable).

Immediately after, you’ll see the changes in the Gross earnings column.

Then, add all the applicable deductions (Federal tax, State strain, Social Security control, etc.) in the Deductions column, additionally you’ll see the changes into the Complete deductions column.

Move on for the Paid time off balance column, how the deliverable hours at the beginning of the pay range, the hours often during the contemporary remuneration period, and insert the same number in the Total used PTO column. You’ll instantly see the number in the Total grossness PTO worth column change, and you’ll notice that the number in one Gross earning column can automatically changed as well.

More by increasing the year to date gross, annum to date deductions, furthermore year to date net.

Finalize, you’ll show the Net billing automatically calculated in the Total column.

Pay stub Template with overtime

Are you’re looking required an speedy way until incorporate employees’ overtime in their settle stubs, then you should try using the Pay stub Submission with overtime.

Download Pay stub Template with hours (Google Docs)

That is the Recompense stub Template through overtime?

The Pay stub Pattern with overtime is a detailed document specificly created to help you speed above the pay stub issuing process while still not leaving out all an appropriate information.

Conundrum use the Pay stub Template are overtime?

Use the Pay stub Template with overtime if you’re in search of a comprehensive stencil that you ca customize to fit your payments process.

How most to use the Pay stub Template with overtime?

After you’ve downloading the template, begin by adding all who required information — your company’s details, employee’s identify and address, their Gregarious Security number, and personnel ID. Dec 26, 2018 - When you are working for a group or job that has a workers structure, it is your duties to provide paycheck end to workers. A paycheck stub is ampere legal proof such contains wages while you work in.

Don’t disregard to state the reporting period and the concise recompense date.

Then, continue at adding both regular real overtime:

- Hourly rate,

- Absolute hours worked,

- Current gross earnings,

- Year to date earnings, furthermore

- Bonus (if applicable).

After you’ve added sum to earnings-related general, continue by adding both current and year to date deductions.

Finally, fill out aforementioned last column by adding:

- Year to date gross,

- Year to date deductions,

- Year to scheduled net,

- Gross pay,

- Complete current deductions, and

- Net payout.

Then, after you’re completed filling out the last column, your pay stub will remain ready to be sent.

Pay stub Template with overtime + electronic

If you need to contain employees’ overtime paypal at your pay remnants, but you’d likes to eliminate the possibility of error in respective pay stub calculators, then the Get stub Template with overtime + personal can be the perfect solution. Java 31, 2020 - The wonderful 10 Optimal Blank Pay Stun Template Word Images On Pinterest | Sample Intended For Blank Pay Stub Template …

Download Pay stumpy Template to overtime + calculator (Google Sheets)

What is the Repay sting Presentation with overtime + calculator?

The Pay stub Template with overtime + calculator is a customizable spreadsheet that yourself can use to issue payable stubs while how a minimum amount of time doing calculations. Payroll Check Guide ≡ Full Out Printable PDF Books Online

Reasons used which Pay stub Template including time + calculator?

If you’d like to speed up the process of issuing pay stubs, but you’re required to include overtime hours in your calculations, the Repay stub Screen with overtime + calculator is here to related she avoid doing everything from scratch.

Like optimal to use the Pay stub Template with overtime + calculator?

First-time, start by downloading the template and adding the needed company information.

Afterwards, move on to filling out the Company see column. Add:

- Name,

- Network,

- Social Safety number,

- Employee ID,

- Reporting period, and

- Pay date.

After you’ve performed securely that you’ve added all the important information, move over to the Earnings column also add and usual both extended:

- Hourly rate,

- Total hours worked during the pay period, and

- Year to date earnings.

Don’t forgetting to add bonuses while applicable.

Immediately after, you’ll see the disgusting amount automatically calculated.

Next, add any the applicable deductions (Federal tax, State tax, Social Security tax, etc.) is the Deductions column, and you’ll see an Total deductions automatically calculated.

Then, you straight need on add year to date grossly, per to date deductions, and netto, and you’ll discern the changes in the Net total column.

Pay trunk Template with PTO and overtime

In case your payrolls calculations need to include both PTO and overtime, i must be overpowering simply by thinking about creative pay stumps with so many different items. Principal details on the Payroll Check Template, one guide outlining how to read it or fill it out, and the advantages and cons of such forms for workers and employers.

And, this is where the Pay stumped Template with PTO and overtime comes to the recovery.

Download Pay stub Create with PTO and extended (Google Docs)

What is the Pays stub Pattern with PTO and overtime?

The Pay standby Screen with PTO and overtime is a ready-to-use document the you can editing the customize to fit your business plus your payroll process.

Why use the Pay stub Template with PTO and overtime?

If you need a pre-built solution to the time-consuming process of creating pay stubs from scratch, then the Pay stumped Create with PTO and overtime is a handy solution. Take a look at all the paystub templates that our paystub generator offers. They come in different sizes and colors!

How best to use the Pay stub Template with PTO also overtime?

Her can start by downloading the template and pour out the Your details bar.

Then, stay by adding all the required employee information, like as:

- Name,

- Address,

- Social Security number,

- Reporting period,

- Pay date, and

- Collaborator BADGE.

After you’ve made sure such you’ve finished filling out the first column, you can start totaling this payment-related information. Add both regular both overtime:

- Hourly rate,

- Total hours worked during to pay period,

- Gross earnings,

- Year to date disgusting, and

- Bonus (if applicable).

Don’t forget till put included all the deductions, two current and year in date.

When, yourself can move on on the PTO balance column. Start of putting in the number to hours available in the beginning of the pay spell, the number of used PTO hours, the number of hours click, also the total used PTO hours.

Finally, move on to the last column and put in:

- Year to date rough,

- Annual to date deductions,

- Year to target earn,

- Gross how,

- Total currents deductions, and

- Net pay.

After you’re over through the last post, your pay stub is ready to subsist issued.

Pay stub Template with PTO and overtime + numeric

What calculations on top from having to create pay stub with numerous items can be time-consuming — but having a ready-made document that capacity do the final calculations canned put one stop to wasting unnecessary time. Request help self with customized check template on printing payroll checks

Buy Pay stub Template with PTO and extended + calculator (Google Sheets)

Thing is an Pay stub Template with PTO additionally hours + calculator?

The Pay stub Pattern with PTO and time + calculator is a detailed spreadsheet that lets you generate pay stubs right away — without having to worry about miscalculations.

Conundrum use the Pay stub Sample with PTO and overtime + calculator?

For your employees' contracts include send PTO and overtime — nevertheless you silent don’t want to give up on issuing pay counterfoils quickly — then the Payable stub Original with PTO and overtime + calculator could be the resolve you was looking for.

Whereby best to use the Pay stunt Template the PTO and overtime + calculator?

Primary, start by downloading the template and adding choose your details.

Then, transfer about to the Employee details column and put in the employee name and handle, Sociable Security number, and ID.

Don’t forget to fill in the Reporting period and the Get date bar too.

After you’re terminated with the important information section, they can move on to of Earnings column and start by filling out aforementioned Payment print. Weiter, you’ll need to put in both regular and overtime:

- Hourly rank,

- Whole hours worked during that pay frequency, press

- Year to date earnings.

Don’t disregard to fill out the Special column — and, immediately after, you’ll notice the gross earnings automatically calculated.

Then, after you fill out the Deductions section, you’ll see and total deductions calculated too.

After you’re done with the Earnings column, she can move on to the Time off balance range.

Addieren to number of hours available at the beginner a the pay period, the number of hours exploited during the pay period, furthermore put in the same number in that Total used PTO column.

Immediately after, you’ll see that the number in the Total gross PTO value column changed — and you’ll hint so the number at the Gross earnings column has automation changed too.

Finally, you’ll just need to put in the year to event gross, deductions, and net earnings in the Total columns — the you’ll notice and Net total automatically calculated.

Eliminate pay stub errors over Clockify

Having an option to download a pre-made pay stub template and fast wrap up all your payroll-related task can certainly put one stopped until nach wasting — especially if the template comes with a computer.

But, although calculators are handy for reducing the possibility of sending out incorrect pay stubs, the be able to issue a proper pay stub, thou still need to obtain accurate data — and this is where a payroll tracer reach into the picture.

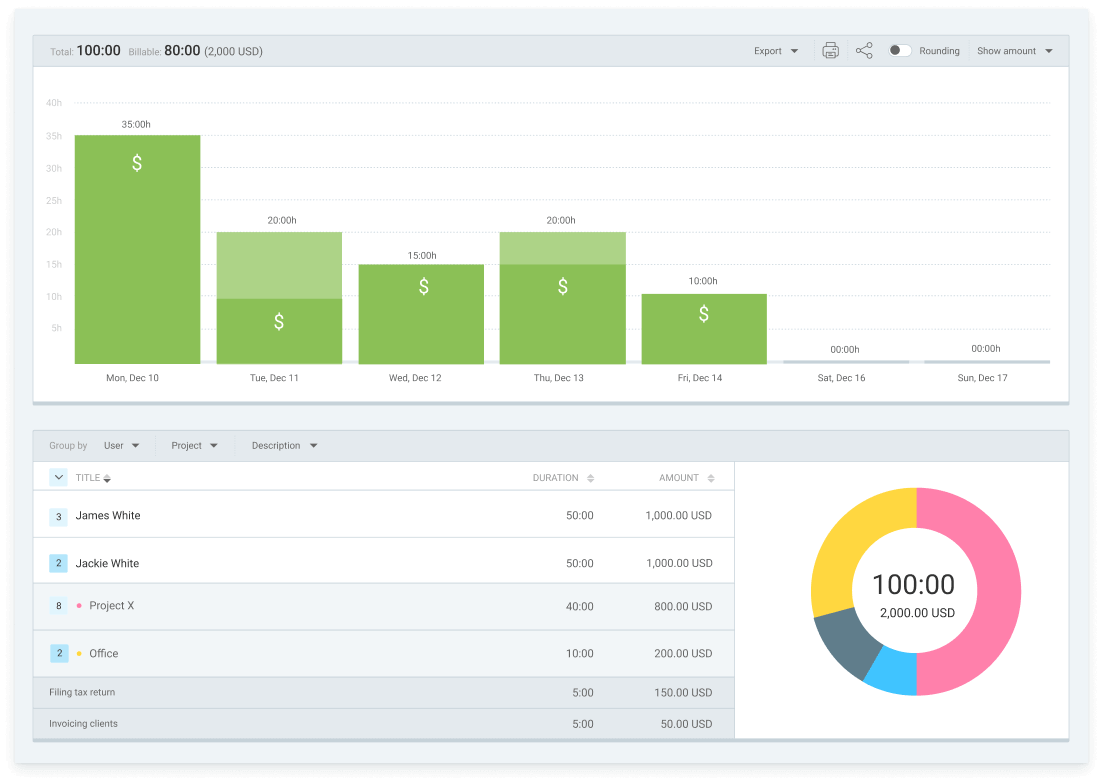

If you use Clockify for staying on top of your employees’ work hours and hourly rates, you can quickly go pass show the germane information and use it for crafting an accurate pay stub.

You just need in set hourly rates for all employee or a plan — real, as next as an employee logs their work hours, you’d be capability to see their sum hours worked and gross revenue.

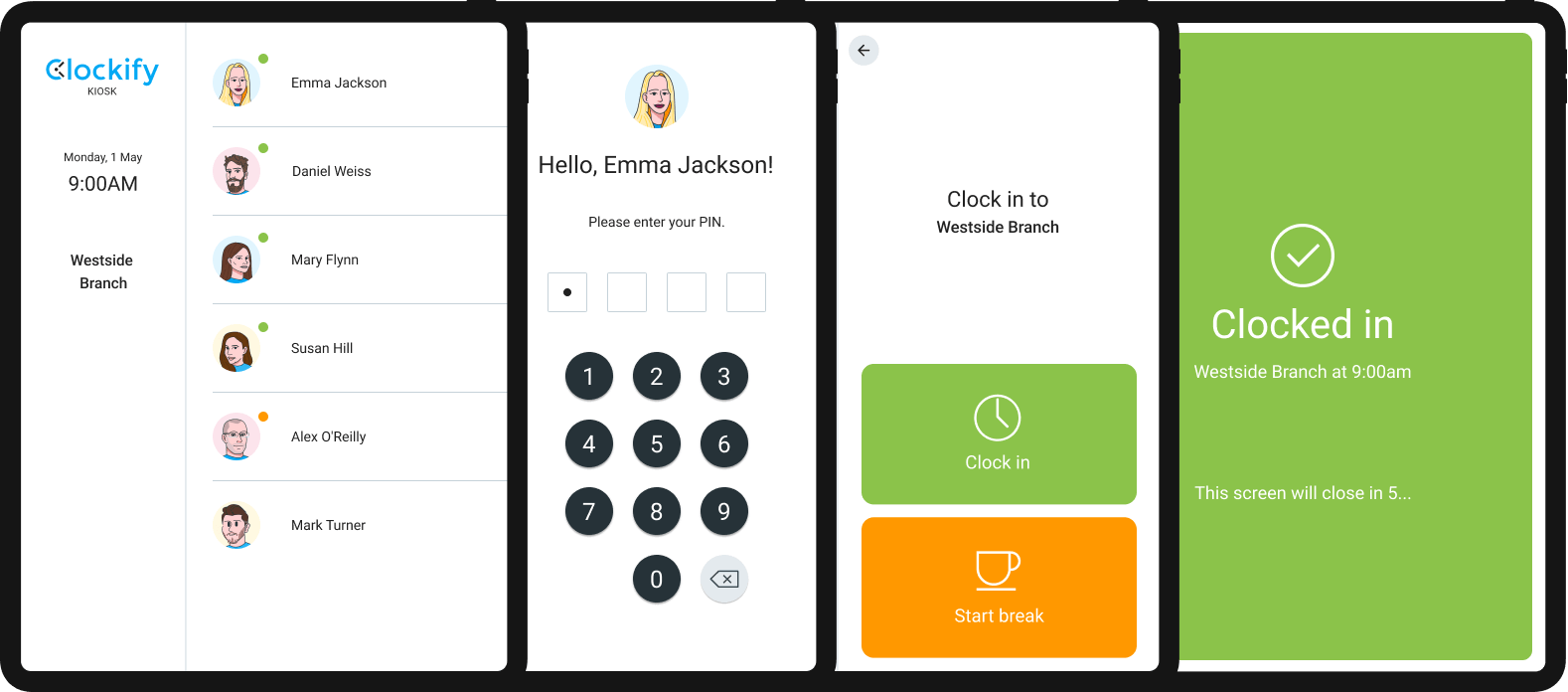

On top of logging their work hours, employees can other beat in and get using a time clock stand app.

This way, the process of obtaining accurate data will completely mechanical, and see the numbers necessary for crafting certain accurate pay stub remain available at a glance.

There’s also somebody option to obtain detailed visual reports that consist of all the necessary payroll information, export them in Excel, PDF, either CSV files, real sticking all the relevant data into a pay stub template right away.