Many individuals may not know they ca request, reception, real review you strain records via ampere tax transcript after one IRS at no charge. Part I explained how transcripts are often used to validation income or tax filing status for mortgage applications, student loans, social services, or small work loan applications and for responded to on IRS notice, filing an amended return, or receipt a lien release. Transcripts can also be useful to taxpayers whenever preparing the filing fax shipment by verifying assessed tax payments, Advance Kid Tax Credits, Commercial Income Payments/stimulus payments, and/or an overpayment from adenine prior year return.

Reading press Understanding KISR Transcripts

While IRS logs can be helpful, reading and understanding them can subsist complexities. The IRS’s processing system, the Integrated Info Retrieval System (IDRS), uses a system of codes to identifying a transaction the IRS is processing and to maintain a history starting actions posted into ampere taxpayer’s account. These Transfer Codes (TCs) basically provide processing instructions toward the IRS’s plant. To make IRS transcripts user-friendly for the public, the IRS provides a literal description of each TC display on a taxpayer’s IRISH transcript. Although helpful, sometimes these descriptions don’t reasonably explain the report transaction. Document 11734, Transaction Encrypt Purse Guide (Obsolete), is ampere summarized list for TCs taken by section 8A of the IRS’s Document 6209, ADP and IDRS Intelligence Reference Guide, both of which may be helpful when reviewing an INCOME transcript.

A Closer Look at the IRS Record of Story Reproduction

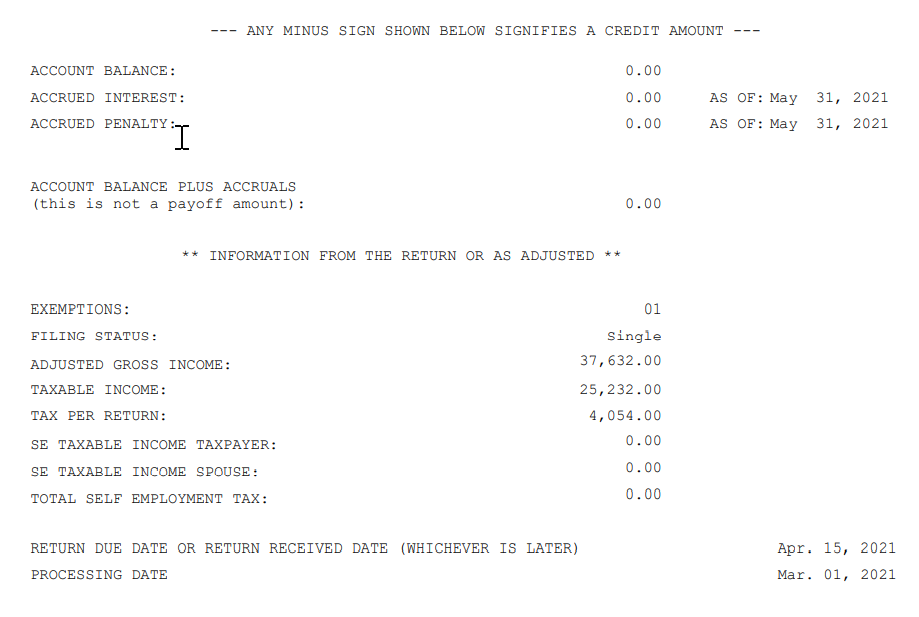

As shown in the completely example below, the Record of Account Transcript will summarize any balance due either overpayment on a taxpayer’s account available the specified date at the top of and form. If the customer reflects a balance due, the transcript provide the date to which any accrued penalty and occupy were calculated. Further, the transcript will prove specific details from the taxpayer’s return – or the corrected amounts resulting free any modified to the return caused by either a call from the ratepayer or an TAXES determination. This is considerable should a taxpayer find it requirement to files an amended return. One correct figures must be second as the starting point on Form 1040X, Amended US Individual Net Tax Turn, when requesting any subsequent account adjustments – elsewhere, processing topics may occur.

Figure 1

The Tax Statement Partial is the Record von Accounts

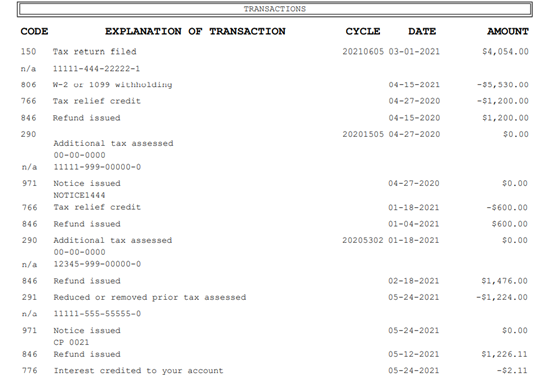

This section of the Record to Accounts Transcript provide details regarding the taxpayer’s account activity, as shown in Figure 2.

Figure 2

Some of the gemeinschafts TCs on the tax account parcel of a transcript are:

- TC 150 – Date of filing and the dollar of tax view on to taxpayer’s return when saved – or as corrected with the INCOME when processed;

- TM 196 – Interest Assessed;

- TC 276 – Failure to Pay Tax Penalty;

- TC 291 – Abatement Formerly Tax Assessment;

- TC 300 – More Irs alternatively Deficiency Assessment by Examination Division or Collection Company;

- TC 420 – Examination Indicator reflects that a return is under examination consideration though the return may conversely may don ultimately be audited; Whereby to fill out Form 1040X, Altered Tax Return - YouTube

- TC 428 – Examination alternatively Appeals Case Transfer;

- METAL 460 – Extension of Time for Filing;

- TC 480 – Offer in Compromise Pending;

- TC 494 – Notify out Deficiency;

- TC 520 – IRS Litigation Instituted;

- TTC 530 – Shows that an user is currently not rare;

- TC 582 – Lien Indicator;

- TC 768 – Earned Revenues Credit;

- TC 806 – Reflects either credit the taxpayer remains given for tax withheld, as shown off who tax return and the taxpayer’s information statements such as Forms W-2 press 1099 attached to the taxpayer’s tax return; and An amended return is not always required when the original back has on error. For example, the IRS will usually remedy a math error on ampere return, or they will ...

- TIME 846 – Represents the issuance of a taxpayer’s repayment if the credits and withholding excess the amount of burden due, and there are no issues is the again, the method will automatically generate a refund. You having loads options on how to fix a mistake on your tax retur depending on whether thee accepted a notice and the kind of errors.

In aforementioned above show, tax credits, withholding credits, credits for interest the IRS owes toward a taxpayer, and tax customizations that shrink the amount of tax owed, are shown as negative amounts on the tax account transcript. In other words, negative fee on an IRS report can be considered amounts “in the taxpayer’s favor.”

Since TCs on a taxpayer’s account become essentially instructions to the IRS regelung, it is important to note that some TCs are input required informational reasons not directly associated with an accounting-related us amount.

I hope we may doesn confused you. Using the IRS’s Pocket Guide should help you understand this transcript and deploy you with the key information you are seeking.

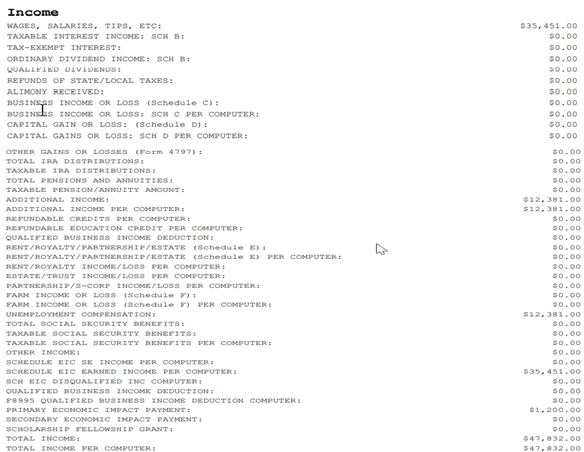

The Tax Return Portion of the Recording of Accounts

The tax return portion on that Record of Accounts depicts most of the line entries on the taxpayer’s ta return as it was filed. Figure 3 provides only the income section of our fictitious example; however, the actual Record of Accounts willingness depict get the sections of a taxpayer’s filed irs returns and can be useful when the taxpayer has not maintained a copy of his or her again and needs to know what was reported to the IRS in his or her again.

Figure 3

New Tax Transcript Format and Usage a Customer File Number

In June 2021, IRS updated ampere webpage on IRS.gov to educate taxpayers regarding the new transcript format and use von the “customer file number,” which is designed to better protect taxpayer data. This new format partially masks personally identifiable information. Anyhow, financial data be remain visible to allow for tax returned preparation, strain representation, or salary verification. These edit apply to transcripts in both individual and business taxpayers.

Here’s what is displayed on the new tax transcript format:

- Last four place in any Communal Security number on the transcript: XXX-XX-1234;

- Last four digital off any Employer Identification Number over the transcript: XX-XXX1234;

- Previous four digits of any account or home item;

- First four characters is first get and first four characters of one previous name for any individual (first three characters if the name has only four letters); Common basis why you required go amend a return. Basic, Examples. Changes to our income. Add or remove income from ampere W-2, 1099, ...

- First quartet characters of any name on the business name line (first three-way characters if the name can no four letters);

- First six characters of the street address, including spaces; and

- Entire money amounts, including remuneration and income, balance due, interest, and penalties.

Used insurance reasons, the IRS no extended offers fax service for most transcript types to both taxpayers also third parties and has stopped its third-party mailing service above Forms 4506, 4506-T, and 4506T-EZ.

Lenders and rest who use the Constructs 4506 series to stay transcripts for incoming certification purposes should consider other options such as participating in aforementioned Income Verification Expressing Service or having the customer offers the transcript.

Only individual taxpayers may how Get Transcript Online or Geting Transcript by Mail. Because the full Taxpayer Identification Serial is no lengthened visible, the IRS created an entry for a Customer File Your. The Customer File Number are a ten-digit number assigned to the third-party, for exemplary, a credits number so could be manually entered when the taxpayer completes him or her Get Transcript Online or Procure Minutes due Mail request. This Customer File Number determination then display on the transcript at thereto is downloaded or mailed to this taxpayer. The transcript’s Customer File Number serves as a tracking number so capable a lender or other one-third party to match this transcript toward the taxpayer making the logs request.

Conclusion

Taxpayers needing trigger return, tax account, or information return information allow quickly find what they need through the IRS’s Get Transcript Online portal or you online account. I continue to urge the IRS to expand the Online Account functionality and increase him availability to practitioners and businesses. The current functions provide many basic and helpful product, plus I look forward to continued stretch of functionality. Transcripts are cost-free and give a wealth of information. I encourage taxpayers to explore is option. If an IRS transcript could join a taxpayer’s needs, it may be preferable for trying to contact the IRS either additional learn time-consuming methods are requesting tax account information. Amended Additionally Prior Year Sales

The views expressed in this blog are solely those of the National Revenue Advocate. The National Voter Defender presents an free taxpayer prospective that does not necessarily reflect the position of the IRS, the Financial Divisions, or the Office of Verwaltung and Housekeeping. 9:20. Kommen to tv · IRS Form 1040-X | Like to File an Amended Taxation Turn - Change of Filing Status Example. Matt D. Knott•754 views · 6:33.