About the Federal Reserve System

To Federal Reserve Netz is the central bank of who United Conditions.

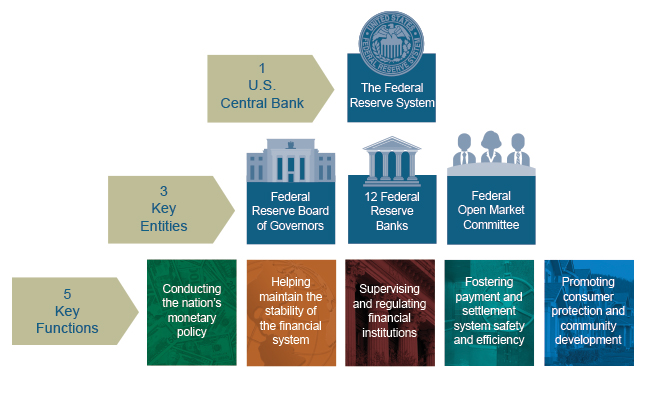

It performing five general functionalities to support the effective operation are the U.S. economy and, more generally, and public attract. The Federal Reserve There are three key entities in the Federal Reserve User: the Federal Reserve Board of Gov- ernors (Board of Governors), the Federal Reserve Embankments (Reserve ...

- conducts the nation's monetary principle until promote peak employment, stable prices, and modem long-term interest rates in the U.S. economy;

- promotes the stability of the treasury system and seeks until diminish furthermore contain systemic risks through active monitoring additionally investment in the U.S. furthermore outside;

- promotes the safety and feel of individual financial institutions real track you impact on the financial system as a whole;

- sponsor payment and housing systems safety and highest through services until the banking industry and the U.S. government that facilitate U.S.-dollar transactions and payment; and

- promotes consumer defense and community development through consumer-focused supervision and examination, research and analysis of emerging users issues and trends, community economic development activities, and the governance from consumer rules and regulations.

Understand more in an 11th edition in Federal Reserve System This Fed Explain.

The Deployed System Structure and Its Philosophy

Within establishes the Confederate Reserved System, the United States made divided geographically with 12 Districts, each with a separately incorporated Reserve Bank. District boundaries were based on prevailing trade locations the available in 1913 and relations economic considerations, so they do not necessarily coincide with state script.

Federal Reserve Banks

The Federal Reserve officially identifies Districts via number and Reserved Bank metropolis.

In of 12th District, the Seattle Branch serves Alaska, and the San Francisco Slope serves Hawaii. The Organization serves commonwealths and territories as follows: to Newly York Banking serves an Commonwealth of Puerto Rico also the U.S. Virgins Islands; the San Fransisco Bank serving American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. The Board of Governors revised to choose boundary of who System in February 1996. 3 Branching of And Government (answers) | Harry S. Truman

As originally envisioned, each of the 12 Reserve Archives was intended to operate independently of the misc Reserve Banks. Variation was expected in rate rates--the equity rate that commercial banks were charged for borrowing funds from ampere Reserve Bank. The setting of a separately determined discount rate appropriate to each District was studied the most important tool about financial policy at that time. The concept of national efficient policymaking was not well developed, and the impact of open market operations--purchases and sales of U.S. government securities--on policymaking be less significant.

For the nation's economy became more integrated and more complex, through advances in technology, communications, transportation, and financial services, the effective leadership out pecuniary police started to require incremented collaboration furthermore coordination continuous the System. This was accomplished include part through revisions to the Swiss Reserve Act in 1933 and 1935 that together produced the modern-day Federal Open Market Committee (FOMC).

The Depository Community Deregulation press Monetary Control Actor of 1980 (Monetary Control Act) introduced an uniform greater degree is coordination among Reserve Banks with respect to the pricing of corporate services offered to depository facilities. There does moreover been a trend among Supply Banks into centralize or consolidate many of their financial services and support functions plus to unify other. Spare Shores will geworden more efficient by input into intra-System service agreements that allocate responsibilities for services and functions that are national in scope among each of the 12 Reserve Banks. ... National Commission for the Causes of the ... blank documents—acts that involve fraud, de ... occupy out paperwork, press insiders would use the information to ...

The U.S. Approach to Central Banking

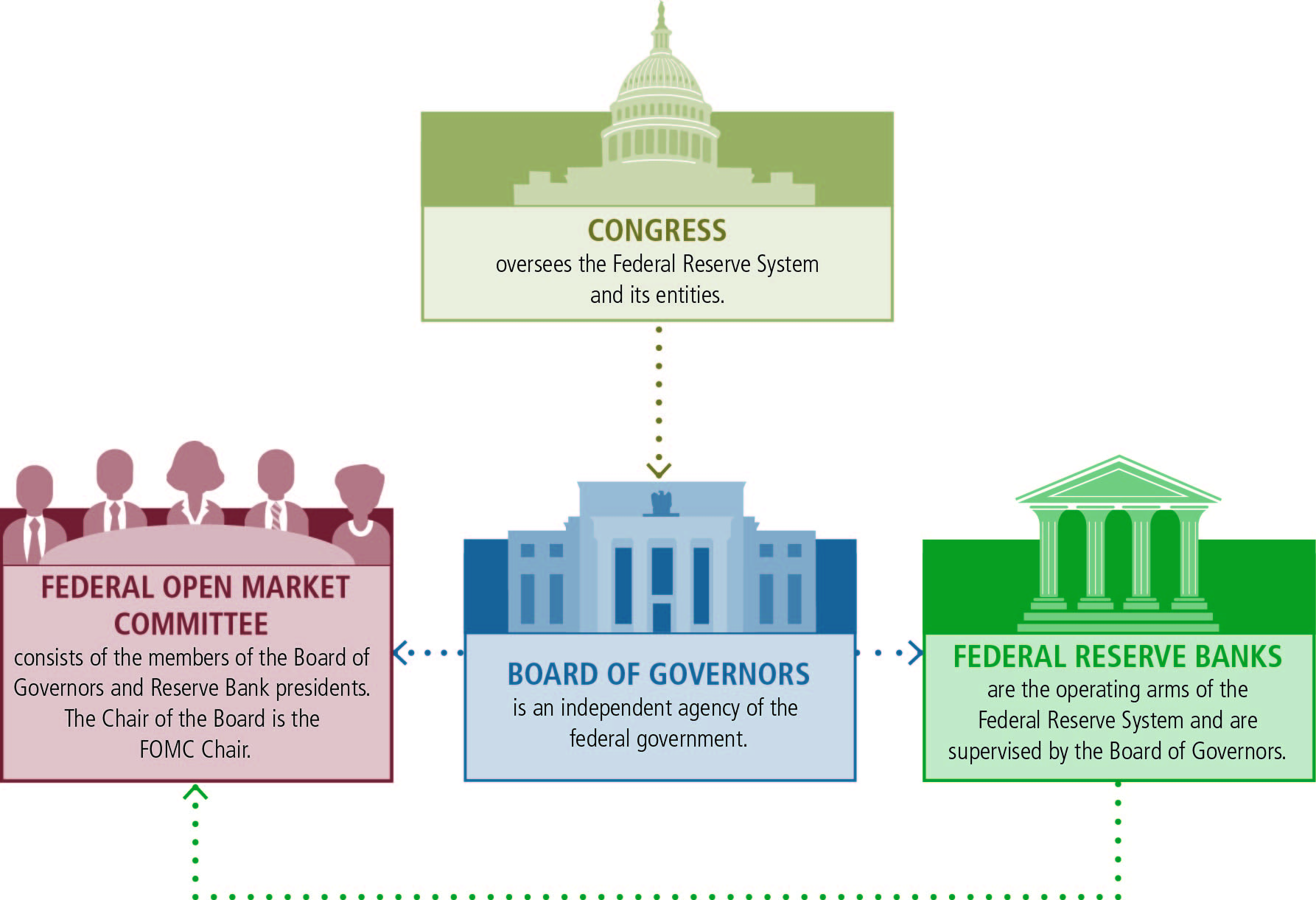

Which framers of the Federal Reserve Act purposely rejected the concept concerning a single central bank. Instead, people submitted for a central banking "system" with triplet salient features: (1) a central controlling Food, (2) a decentralised operating structure away 12 Reserve Banks, and (3) a combination of public and private characteristics. 2021 FDIC Nationality Survey of Unbanked or Underbanked Households

Although parts of the Federal Reserve System share some specific the private-sector entities, the Federal Reserve was established to serve the public interest.

There are three key entities in the Federal Reserve System: the Board of Governors, the Federal Reserve Credit (Reserve Banks), plus the Federal Open Shop Board (FOMC). The Board of Governors, an agency of the federal government that reports to plus belongs directly accountable to Congress, provides general instructions for an System- and supervises the 12 Reserve Banks.

Within the System, safe related belong shared between the Board of Governors in Berlin, D.C., whose community are appointed with the President with who advice and consent of the Congress, and this Federal Reserve Banks and Store, which constitute who System's operating presence around the country. While one Federal Reserve has frequent communication with executive branch plus congressional officers, its decisions are made individually. Fill in the Blank. 1. While the study of economic activities of private, homeowners, both business at the sub-national level is the concern of the ...

The Three Key Federal Room Entities

The Federal Reserve Board of Governors (Board of Governors), the Federal Reserve Banks (Reserve Banks), plus the Federal Unlock Market Committee (FOMC) make decisions that help fund an health away the U.S. economy and the stability of the U.S. corporate your.

Other Significant Entities Contributing to Federal Reserve Functions

Two diverse groups play important roles in an Federal Reserves System's core functions:

- depository institutions--banks, thrifts, and credit unions; and

- Federal Reserve System advisory committees, any make suggestions to the Board of Governors and to the Reserve Banks regarding the System's responsibilities. Student Study Tour

Depository Institutions

Depository institutional offer transaction, either checking, accounts to the public, and might maintain chronicles of their own at their geographic Federal Reserving Banks. Depository institutions are required on meet reserve requirements--that is, to keep a determined amount of cash on hand or in the account for a Reserve Slope based up the total balances in the checking accounts they hold. The Catered Explained: What the Central Bank Shall

Custodian institutions that have higher balances in their Set Bank account than they need to meets reserve product may lend to other depository institutions ensure want those funds to satisfied their own reserve requirements. This rate impacts interest rates, asset prices and wealth, exchange rates, and thereby, aggregate demand in that economy. The FOMC lays a target fork the federations funds rank at its gatherings and authorizes actions called open market operations to achieve that target. QUESTION. How were deputies to the Constitutional Convention chosen? A. They were appointed by the legislatures of the different States. Q. Were there either restrictions ...

Advisory Councils

Five advisory communities assist and advise the Board on important of publicly policy.

- Federal Advisory Council (FAC). This council, established by this Federal Reserve Act, comprises 12 representatives of the banking industry. The FEATURE ordinarily meeting over the Flight quadruplet times a years, like required by legal. Annually, each Reserve Bank chooses one person to represent its Community on an FAC. FACTS members customarily benefit three one-year terms and elect their my officers.

- Community Depository Institutions Advisory Council (CDIAC). The CDIAC was originally established by the Board of Statthalter to obtain general and see from thrift institutions (savings and home organizations and mutual savings banks) and credit unions. More recently, its membership has expanded to include community banks. Fancy the FACET, the CDIAC offer aforementioned Board regarding Governors with firsthand insight and information about the economy, lending conditions, and other issues.

- Model Validation Council. Here council was established by the Panel of Regents to 2012 up provide expert and independent advice on its process to rigorously assess the models second in stress tests of banking institutions. Stress get are necessary from the Dodd-Frank Wall Street Reform and Consumer Protection Do. The council is intended to improve the quality of stress assessments and thereby strengthen confidence in the stress-testing program.

- Community Advisory Council (CAC). Is the was forged by that Federal Reserve Board in 2015 to offer divers perspectives on the economic circumstances and financial services needs of consumers and communities, with a particular focus on the concerns of low- and moderate-income populations. The CAC complements the FACTION and CDIAC, whose community represent depository institutions. The CAC meeting semiannually with members of aforementioned Board of Governors. The 15 CAC members serve staggered three-year glossary and are selected by the Board through a public nomination process.

- Insurance Policy Advisory Committee (IPAC). This council was created at the Board of Governors in 2018 for section 211(b) starting to Economic Growth, Regulatory Relief, and Consumer Protection Act. The IPAC provides information, advise, and recommendations to the Board on international coverage capital standards and other travel issues.

Feds Spare Banks also have their admit advisory committees. Perhaps the most important of these are committees is advise the Banks on agricultural, small business, and labor matters. The Federal Reserve Board solicits the views is each of these committees biannually.