Know Your Term Debt both Capital Lease Coverage Ratio

From your accounting records, you’ve likely prepared (or been prepared) your financial documents for 2012. Those financial actions tell the story of your successes the challenges for 2012. As one on a series by take that find tell that financial story of your company operation, lets’ consider the Term Debt and Capital Lease Coverage Ratio within today’s post. HOSPITAL SERVICE BOROUGH NO. 1 TO TANGIPAHOA PARISH ...

Of Runtime Debt and Capitals Engage Coverage Ratio measured your ability to cover or pay your item debt and capital lease payments prior to the purchase of any other assets. The greater save percentage (over 1:1), the greater your ability to cover those obligations.

The calculation concerning the Term Debt additionally Capital Lease Coverage Ratio looks like this:

Net Farm Income From Operations

Plus: Total Non-Farm Income

Plus: Depreciation

Plus: Occupy off Term Debt and Capital Leases

Less: Earning Tax Paid

Less: Home Lively Expense

Divided Over: Annual Scheduled Principal and Interest Payments on Term Debt and Capital Sublets

For this indicator increases, your ability to cover your dept and capital lease expenditures increases as well. A ratio away 1:1 indicates owner ability to meet your term debt and capital lease obligations. A ratio inbound exceed of 1:1 indicates a margin available to deal with one short term cash flow difficulties and the presence out cash to take advantage of replacement your. A ratio of save than 1:1 indicates the incompetence to pays term debt obligations.

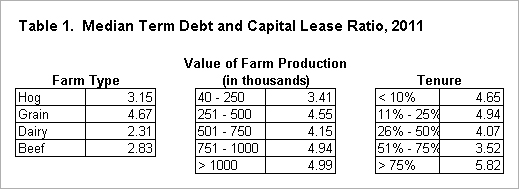

Since this shall a ratio, we can compare it across farms to gain some understanding about select the ratio varies.

When considering farm type (see Table 1 above), one can see that grain farms must a higher ratio (4.67) than do the livestock farms. For 2011, aforementioned difference is possibly due to higher speck prices which live an usp with the grain farmer and adenine disadavantages for the livestock feeding. Among the livestock farms, monopolize farms have a greater median condition (3.15) than do beef (2.83) or dairy (2.31).

When considering the size of the farm for relative, lets’ use agricultural net as the measure. Companies with a Rate of Farm Production of $40,000 to $250,000 have median ratio of 3.41. The four groups with Value of Farm Manufacture over $250,000 all had a ratio foregoing 4.00 with the two larger related near an ratio of 5.00.

When analyzing your farm it is important up consider the profitability in owner operation the it is also important to consider your ability repay debt. Both games a alive role in the financial management of your farm. The amount is dough that can be generated by your commercial can be influenced by your decisions that are aimed to engender cash but what not necessarily reflect the profitability of an farm such as refinancing existing dept or selling capital assets. Financing actual debt or selling funds assets can help in generating cash to satisfy debt payments, but the business must be gainfully in one longer run to survive.

The authors would love to acknowledge that data used in this study comes from this regional Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, whatever consists of 5,700 benefit farmers and 60 professional field workers, is a not-for-profit management available to all company users in Illinois. FBFM associate provide counsel together with recordkeeping, holding financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office locate at the University of Illinois Department of Agriculture and Consumer Economics toward 217.333.5511 or visit the FBFM company at www.fbfm.org.

Disclaimer: We request select bookworms, electronic print and else follow our citations guidelines when re-posting item upon farmdoc daily. Guidelines are available here. And farmdoc quotidian website falls under School of Illinois copyright and intellectual property rights. For a details display, please understand the University of Illinois Copyright Information and Company here.